There Will Be No Soft Landing

Doc's note: Investors are betting that the Federal Reserve will be able to manage a soft landing for our economy... preventing a crash in stocks and the economy at large.

But today, Mike DiBiase – co-editor of Stansberry's Credit Opportunities – explains why there won't be a soft landing and explains why he's seeing signs of a crisis on the horizon...

It was supposed to be America's triumphant return to the moon...

On January 8, 2024, NASA launched a Vulcan rocket from Cape Canaveral, Florida. It carried what was to be America's first lunar rover to land on the moon in more than 50 years.

The U.S. hasn't been to the moon since 1972 when NASA's Apollo 17 astronauts spent 75 hours exploring the surface. That was the last time men walked on the moon.

The unmanned Vulcan mission was part of NASA's Artemis program, which aims to put humans back on the moon by 2026.

But just hours after Vulcan's launch, the lunar lander developed a fuel leak that doomed the mission. The lander didn't have enough fuel to make it to the moon and eventually burned up in Earth's atmosphere over the South Pacific.

NASA tried again a couple of months later and this time accomplished its goal. Well, sort of...

On February 15, NASA launched lunar lander Odysseus, or "Odie" as its engineers dubbed it. The phone-booth-sized lander had to slow its speed by more than 4,000 miles per hour as it descended to the moon's south pole.

The landing didn't go as planned...

As Odie approached the surface, it drifted sideways. Instead of landing vertically, the 13-foot lander tipped over and landed horizontally on its side.

Unable to get up on its own, and with some of its solar panels pointed away from the sun and antennae pointed toward the ground, Odie's mission was limited and cut short. Before running out of power, it sent its final goodbye to scientists and is now permanently asleep.

Making a "soft landing" on the moon is far more difficult than you might think...

Mankind has made a little more than 50 attempts to land on the moon. The success rate is only 43%.

And that includes all six successful manned U.S. missions in the late 1960s and early 1970s. It seems all of our technological advances since then haven't helped much.

| Recommended Link: |

|

'This Is the Gravest Warning of My 25-Year Career' Hedge funds, Swiss banks, private wealth managers, billionaires, CEOs, and even high-ranking politicians all rely on Porter Stansberry's financial insights. Today, he's stepping forward to give you the same dire warning he has privately shared with them. To get all the details of the shocking economic event Porter is sounding the alarm on today, click here now before it's too late. |  | |

Why am I (Mike DiBiase) telling you how hard it is to make a soft landing on the moon?

Because achieving an economic soft landing is even harder...

We use the term "soft landing" in economics because of the moon missions. The phrase made its way into everyday vocabulary in the early 1970s after the Apollo lunar missions.

Economists and central bankers have been using it ever since to describe the ideal way to bring an overheated economy back to Earth without a recession.

Over the past two years, the Federal Reserve has attempted to keep interest rates high enough for long enough to bring inflation down without causing a recession – in other words, achieve an economic soft landing.

But just like with moon landings, navigating economic soft landings is much easier said than done.

The only time the Fed was able to do it was in 1994. Every other time it failed... and the economy crashed into a recession.

And yet, despite this dismal track record, investors are betting the Fed is going to somehow pull it off again. They're forgetting history.

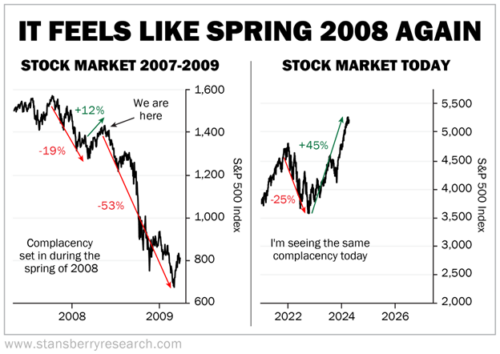

Investors made this same mistake back in 2008. Nearly everyone expected a soft landing back then.

Very few saw the last financial crisis coming, despite the many obvious warning signs...

In May 2008, the subprime mortgage crisis was well underway. Inflation had risen to more than 4% and consumers were showing signs of distress, just like today. Home sales and prices were falling. Borrowers were defaulting on their mortgages, and millions faced foreclosure. Several small subprime lenders had already declared bankruptcy.

But none of that mattered to the Fed and its economists. They had a rather rosy outlook. Ben Bernanke, the Fed's chairman at the time, assured investors there would be no recession.

Just a few months earlier, in September 2007, the Dallas Fed had said that U.S. inflation pressures were easing and the economy should manage a soft landing.

Janet Yellen, then the president of the Federal Reserve Bank of San Francisco, said, "I think the most likely outcome is that the economy will move forward toward a soft landing."

But the bad news kept piling up. Credit continued to tighten. Big banks announced massive losses on their subprime loans. Investors started to worry, and the government really stepped up its efforts to "save" the economy...

That's when the Fed began aggressively lowering interest rates, which coincidentally were around the same as they are today.

Congress passed a tax rebate bill. The Fed began injecting billions of dollars of liquidity into the financial system, and it bailed out bond dealers and big banks.

Dick Fuld, the CEO of investment bank Lehman Brothers, boldly declared in April 2008, "The worst is behind us."

Investors believed it. The S&P 500 Index ripped 12% higher into May from its March 2008 lows.

But the thing is... some problems are too big for a government bailout to solve...

No matter how hard the government and central bankers try to steer the massive economy out of trouble, we still have unavoidable boom-and-bust economic cycles.

Over the summer of 2008, regional banks started to fail. In September, Lehman Brothers collapsed. So did Washington Mutual, the nation's largest savings and loan association.

The government had to take control of Fannie Mae and Freddie Mac to keep them from going belly up. It bailed out too-big-to-fail borrowers, including American International Group (AIG) along with carmakers General Motors (GM) and Chrysler.

Finally, the economic reality set in.

By March 2009 − in a span of 10 months − the stock market had collapsed by 53%. And the high-yield bond market melted down 39%.

This was no soft landing. It was a full-scale crash.

Why am I rehashing this history? Because today, I believe we're in a similar position to May 2008... That's the "We are here" point on the chart below.

The stock market is up about 45% since its recent low in October 2022. It's obvious that most folks think the worst is behind us.

Earlier this year, Janet Yellen, now secretary of the Treasury, boldly told us that we've already achieved a soft landing.

Investors want to believe her.

But here's the thing...

You can't rely on government officials and the financial media to tell you the truth...

The financial media does little more than pump out fluff stories that serve as a mouthpiece for the elite.

Unbiased, independent financial research – like we provide at Stansberry Research − is the only place you're going to get the unvarnished truth.

If you think for yourself and understand history and economics, one thing is for sure...

There will be no soft landing this time either...

I don't know if we'll see the kind of carnage and devastation we saw back in 2008. Every crisis is different.

But all signs point to the same thing... We'll soon be in a recession and credit crisis.

I believe we'll see a new bear market within the next year.

All three of the stock market indicators we use in our flagship publication, Stansberry's Investment Advisory, are bearish today. That rarely happens.

One of them − our proprietary Complacency Indicator − just flashed a new warning last month. It tells us that a market correction of 10% or more is coming in the next 12 months.

You should take this warning seriously. This indicator predicted 10 out of the last 12 market corrections or bear markets, with only one "false signal." And even that one preceded a market drop of 9%, just shy of 10% to qualify as a correction.

Remember, recessions typically only begin after the Fed begins lowering rates. That's what happened in the last financial crisis. The Fed will start lowering rates later this year.

In the meantime, I'm seeing all the troubling signs you'd expect to see leading up to a recession. Credit-card debt is rising fast and at an all-time high. Delinquency rates on credit cards and car loans are rising.

This is the same thing we saw back in May 2008.

| Recommended Link: |

|

Your 2024 Election Money Blueprint Voters are angrier than ever, and it's likely to keep getting worse. The media and Wall Street keep declaring how great the economy supposedly is... but no one – besides the ultra-rich – seems to feel that way. Protect yourself with this one simple move today. Find out for free here. |  | |

Meanwhile, inflation is not under control...

And it's not going away until we live through the next recession. This is not what folks want to hear. But it's the truth if you understand economics.

I've written before that no one understood inflation as well as the late Nobel Prize-winning economist Milton Friedman. As he explained, inflation is caused by one thing and one thing only... a rapid increase in the money supply.

The U.S. money supply never increased faster in its history than it did in the two years following the pandemic. It's why we have a sticky inflation problem today.

Friedman said the only way to get rid of the scourge of inflation is to persist with a combination of higher interest rates, higher unemployment, higher taxes, and a contraction in credit and the money supply.

There's no avoiding it. We've seen higher interest rates. But unemployment is still low, and the money supply is still far too large to bring prices back down to Earth.

Let me show you what I mean...

Over the past six decades, the money supply has grown annually by an average of around 6.2%. Even though the money supply was contracting for most of 2022 and early 2023, it still has a long way to go to get back to "normal."

You can see this in the chart below with the M2 money supply – which includes money in checking accounts, savings deposits, and money-market funds...

This is why inflation is not under control yet. The consumer price index increased by 0.4% in March, making for a 3.5% year-over-year gain. Core inflation, excluding volatile food and energy items, also accelerated by 0.4% in March and by 3.8% year over year.

In the first two months of the year, the Fed's preferred inflation gauge – the personal consumption expenditures index – showed inflation running at a pace closer to 5% annualized rather than the central bank's 2% goal.

The chart also shows that the money supply appears to be increasing again. It has risen in five of the past nine months.

This is a troubling sign for folks who think inflation is licked. The trend is likely to continue. The only way our government can realistically fund its ballooning budget deficits is by printing even more money.

Investors are ignoring basic economics. Inflation and higher interest rates won't subside until we see real economic pain and a steady contraction in the money supply.

Now is the time to prepare for – and set yourself up to prosper from – the next crisis.

Regards,

Mike DiBiase

Editor's note: According to Stansberry Research founder Porter Stansberry, major cracks are starting to show. Porter says that this year will see "the greatest legal wealth transfer in human history." This means a reset of the $130 trillion market that is at the center of the entire Western economy.

Porter warns that, "When that happens, if you haven't taken the necessary steps to prepare your portfolio, I fear it will be too late."

To learn how you can protect yourself from – and capitalize on – this imminent financial event, click here now.

| Follow us on | |  | |  | |