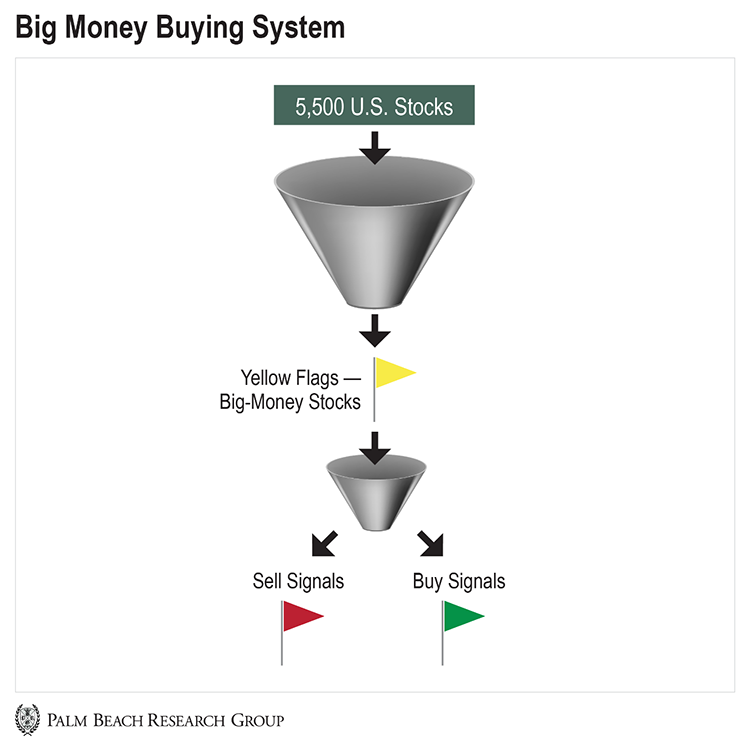

| By Jason Bodner, editor, Palm Beach Insider Work hard, save money, and hope to grow your wealth through investing. It’s a mindset many people have. After all, who wants to stress about investing when you could focus on spending time with family or working on your golf game instead? That’s why most investors choose a passive investing strategy. They put their money in an index fund… and let the market do all the work as it rises massively higher over decades. It’s set and forget. But there are also downsides… | Recommended Link | | America's Top Options Expert Millionaire trader Jeff Clark's options strategies have helped everyday people have the chance to retire wealthy. Which is why Jeff's now offering his complete Blueprint, and a year of his guidance, for just $19. That's right… For a limited time, it's all yours for less than twenty bucks. Because Jeff knows that every $1 you use on his strategies could turn into a windfall in a short amount of time. | | | -- | Along with the gains, you have to be able to stomach any sharp drawdowns. Even though history shows that the market always recovers, it’s hard for many to sit still during heavy volatility. Plus, only a handful of stocks really carry the market higher. In fact, over the past 100 years, just 4% of stocks have accounted for nearly all the market’s profits each year. For instance, just 1% of stocks have accounted for over 50% of the S&P 500’s 35% rally since its March 23 lows. Companies like Amazon, Google, and Microsoft have been doing all the heavy lifting. Now, I call these stocks outliers. And if you’re not targeting these companies, you’re basically wasting your time as an investor. So today, I’ll show you my process for identifying them – and how you can ride them to profits… The Power of Outliers You see, I’ve devoted my life to finding these outliers. They’re the stocks where the big money hides out. And to follow the big money’s trail, I created an “unbeatable” stock-picking system. I used my experience from nearly two decades at prestigious Wall Street firms – regularly trading more than $1 billion worth of stock for major clients – to make sure it’s highly accurate, comprehensive, and effective. | Recommended Link | Did Political Elites Just Hijack Your Retirement? The coronavirus panic is truly unprecedented – no one could have seen it coming... right? Well… It turns out that the government's reaction to the Coronavirus Crash of 2020… was actually 87 years in the making. Politicians are turning to a plan from the 1930s in the hopes of avoiding a new Great Depression. If they enact it… the retirement savings of millions of Americans will be destroyed. Coronavirus may be a serious health disaster… But it's quickly becoming a financial disaster as well. There's already $2.2 trillion in "stimulus." And trillions more are on the way. But make no mistake… All that "free" money is going to be a disaster for any regular American with retirement savings. Which means the "cure" could now be worse than the illness. Former congressional insider Dan Denning predicted this move by our government to "nationalize" the currency – over three years ago. Most people just laughed… But Dan's prediction is now coming true with shocking speed. Dan's chilling conclusion: This could be the end of financial freedom in America. As he says: "If you are an investor… own life insurance or annuities… or have substantial savings in an FDIC-insured bank account… then you need to be aware of serious risks." | | | - | Now, my system scans nearly 5,500 stocks every day, using algorithms to rank each one for strength. It also looks for the movements of big-money investors. When it sees them piling into or getting out of a stock, it raises a yellow flag. Then, I put these yellow flags through another filter. If the flag turns red, it means the big money is selling. If it turns green, it means the big money is buying…

It’s that simple: When I see red, the big money is selling. And when I see green, it’s buying. It takes all the emotions out of investing. Now, these green flags are the market’s next outliers. And my system has already found several of them for my Palm Beach Trader subscribers. Even through the pandemic crisis, we already have three doubles out of 17 open trades. And with Nvidia (NVDA) up over 85% right now, a fourth is likely on the way soon. (Note: NVDA is now above our buy-up-to price, so I don’t recommend initiating a position now.) Overall, we’re sitting on a portfolio win rate of 82%. Our average loss is just 4%, but our average win is 63%! And that’s the power of outliers… | Recommended Link | Amazing 17-Second Video Reveals Key to Tech Fortune… Have you seen this 17-second clip? It's created quite a stir on social media… In fact, it's already been viewed more than 3.1 million times. That's because it unveils an incredible new technology that could be in 75 billion devices by 2025. And possibly create more wealth for investors than all the FAANG stocks combined. | | | -- | Following the Market’s Leaders The bottom line is to stay patient and look at the big picture. And I know that’s hard to do, especially when you’re waiting for a big payoff. But if you persistently follow the big money, you can ride its coattails to big profits in all sorts of market conditions. There will always be market leaders to focus on: high-quality, adaptable companies with proven businesses and little debt. In the age of coronavirus, these outliers are in the infotech and health care sectors. Meanwhile, I’ll continue to monitor my system’s market data and keep you updated on any changes. Right now, it’s signaling the market will be overbought for about another week and a half. But with earnings season coming to a close and negative headlines still prevalent, there are likely more volatile swings ahead. So we’ll stick to our plan of riding this wave until the market crests. Time – and the big money – will tell. And when it does, we’ll take profits, raise cash, and be ready to add more winners on the next short-term pullback. Patience and process!

Jason Bodner

Editor, Palm Beach Insider P.S. Again, my system’s data can truly take the emotions out of investing – and lead to profits, no matter which direction the market’s headed in next. It can help you target the best stocks out there, so you can add them to your shopping list. That’s why I’ve put together this special presentation to show you all the details of how my system works. It’ll help you find the next outlier primed to soar higher, even during the current market volatility. So be sure to check it out right here.

Like what you’re reading? Send us your thoughts by clicking here. IN CASE YOU MISSED IT… Everyday people can live like royalty with these tech investments For the first time ever, a new type of tech investment could help you make more money than you will need for the rest of your life. It's an income stream that allows you to collect cash in your hand every day, week, or month – on new technology. Now, if you aren't familiar with royalties, "tech royalties" are different from other royalty investments. And they're some of the most exciting investments in history. Royalties are periodic payouts... But they're much better than stock dividends. While normal dividend investments have an average annual return of just 1.85%, "tech royalties" could have already handed you extraordinary peak returns of... 517% 770% 987% 1,032% 1,404% 2,526% 2,651% -

Even 9,161% or more… Teeka Tiwari – financial pioneer, tech investor, and former hedge fund manager – has been fortunate to benefit from these five times in his life. So, if you'd like to learn how he did it, and get in first on just one big, new idea in technology... Click here to learn how.

Get Instant Access Click to read these free reports and automatically sign up for daily research. |

没有评论:

发表评论