By David Forest, editor, Strategic Investor If you’ve been following along in the Dispatch, you know I believe electric vehicles (EVs) will soon dominate the market. As fewer and fewer cars on the road require fuel to run, this will lead to lower demand for crude oil… and an increase in the usage of battery metals needed to power EVs. Lithium, the core component of EV lithium-ion batteries, will experience a surge in demand… but it’s projected to face a deficit in the coming years. As demand rises faster than supply, buyers often offer premiums to secure their deliveries. This will be explosive for the lithium price. But it’s not the only metal poised to benefit. Today, I have another key battery metal on my list that’s in high demand. And it could deliver solid gains for those who get in early… | Recommended Link | 10X GAINS UNLOCKED? [1-Day Profits Summit] A rare move from a federal agency could trigger the fastest and largest gains in stock market history. In one day, a small cap could start to soar up to 1,000%. This is a wealth creation event unlike any other. In the past, it has unlocked extraordinary gains like: -

TGTX: 566% -

AMAR: 600% -

NBY: 875% -

ATNM: 900% -

BSEM: 1,130% -

HROW: 1,288% And that’s just the start. Within 12 months, it could turn a tiny stake into a nest egg. This could impact you and your loved ones for generations to come. You’re about to miss out on a wealth creation event unlike any other. | | | -- | It’s All About Performance, Safety, and Cost Today, just about every car manufacturer has its own EV in the pipeline. Each is unique in design, efficiency, and price. But they all have one thing in common – they run on lithium-ion batteries. While lithium is a key ingredient, each battery varies in the amount and types of other metals they’re built with… and some are better than others. While some metals make batteries more efficient, they can be expensive or unsafe. Others are cheap, but impact efficiency. The battery may only run for a couple dozen miles – not even enough for a day-to-day commute. Luckily, car manufacturers have their best brains working to balance this trade-off, to make batteries as cheap, efficient, and safe as possible. And over the last decade, the cost of an EV battery per kilowatt-hour – the standard measure of energy output of an EV battery – went down by 86%. And as cheaper, more efficient metals are used in EV batteries, cost will continue to decrease. One of these metals in particular will dominate in the coming decade. And likely long after… Take a look at the chart below.

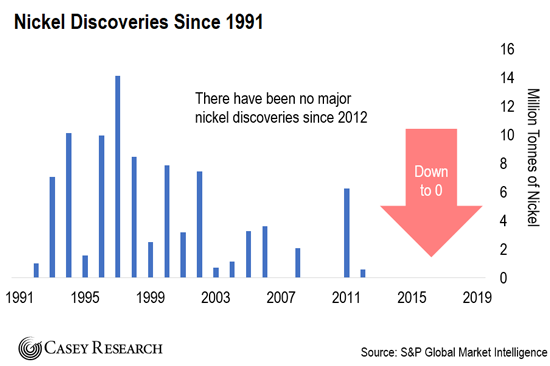

It shows a projection of the different metals carmakers will use to manufacture EV batteries over the next 10 years. As you can see, nickel-heavy batteries, or NMC batteries (the green bars), are most common. Since 2020, EV batteries have been made up of around 80% nickel. And this trend is expected to continue. By 2030, over 90% of lithium-ion batteries will contain more than 60% nickel. And over half of all batteries will contain more than 80% nickel. Nickel is cheap, and it’s efficient. So this is a great plan – but only if miners can continue to supply at this pace. | Recommended Link | Claim Your Stake in the #1 Investment of the Century Starting With Just $10 Former hedge fund manager, Teeka Tiwari, believes this new technology will be the No. 1 Investment of the Century. CNBC reports it will be: “The biggest thing since the internet itself.” And the World Economic Forum predicts it will grow 279,000% over the next few years. It’s NOT 5G, artificial intelligence, the Internet of Things, or cryptocurrency. If you want to know exactly what it is – and how you can claim a stake in it with as little as $10… | | | -- | The Weak Spot Analysts already project a shortage of nickel looming on the horizon. Starting next year, it’s estimated miners will have to boost their production by 25 tonnes to meet demand. And by 2022, they’ll have to boost production by 44 tonnes. It won’t get any easier. Carmakers will need more and more nickel as EV demand continues to ramp up. To keep the nickel market in balance, miners will have no choice but to boost output, either by opening new mines or expanding existing ones. It won’t be simple. It takes about 10 years to open a brand-new mine from scratch. And not many existing operations have the capacity to boost production. In fact, in the last seven years, there have been no major nickel discoveries.

With no signs of major mines coming online any time soon, there’s nothing to close a growing gap between booming demand and lagging supply. What to Do? As demand rises faster than supply, battery makers will start chasing nickel miners, to make sure they have enough metal to build batteries for their growing EV fleet – like Tesla did last month, when it signed a deal with Glencore to secure much-needed cobalt supply:

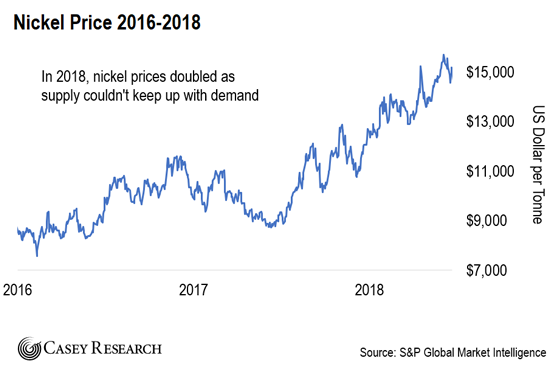

Back in 2018, there was a similar setup with nickel. Constricting supply couldn’t keep up with bullish demand for the metal. And as you can see in the chart below, nickel prices doubled that year.

I expect the same could happen this time around. But given the bullish outlook for EVs and nickel-heavy batteries, and a complete lack of major nickel discoveries, prices could push even higher – and last even longer. Now’s the perfect time to take advantage of this coming nickel boom – before the EV rollout really takes off. To gain exposure, consider investing in nickel miners. They are at the bottom of the supply chain, and will directly benefit from higher nickel prices. Norilsk Nickel (NILSY) is the largest nickel miner in the world. It should get a solid lift once the underlying metal starts rising again. But make sure to position size appropriately here. The company operates in Russia, and while it’s a relatively stable jurisdiction for local companies, there’s still some risk. For a safer alternative, I’ve found a North American miner that operates in a more stable location. You can access it, and other companies poised to benefit from the coming battery boom, by going here. (My Strategic Investor readers can catch up here.) Keep walking the path, ![[signature]](https://files.caseyresearch.com/global/signatures/dforest-sig.png)

David Forest

Editor, Strategic Investor P.S. The electric vehicle revolution is here… and it isn’t slowing down. But it’s just one part of a massive tech boom on the horizon – and the biggest profits will come from small, little-known companies working behind the scenes. And recently, I found a tiny company on the verge of a multibillion-dollar deal with Tesla. It could happen fast. And investors who get in early could pocket a fortune. For all the details on how to take advantage, go here.

Like what you’re reading? Send your thoughts to feedback@caseyresearch.com.

In Case You Missed It… You're doing it wrong… One small corner of the tech boom recently returned extraordinary gains… And most investors missed out. RNC made 900% in 34 days… FVAN made 3,400%… And one company, GGI, made 9,400% in just over three years. A $15,000 investment in GGI would've turned into $1.4 million. While investors were picking over the scraps of the 5G boom… Or trying to decide between Amazon and Apple… They missed a key part of the tech boom. It's not microchips or semiconductors or online advertising… But we can show you a secret way to make a potential fortune on this sector.

|

没有评论:

发表评论