TickerTalk Headlines for July 1st

In this newsletter:

3 Stocks Upgraded by Analysts: Home Depot, U.S. Steel, Alcoa

Investors should take Wall Street's view of a particular sector or stock with a grain of salt, as there are typically conflicts of interest behind these views. Think about it: if an analyst working for an investment bank decides that a company's future is bearish, that analyst could risk losing his or her job over a particular stock's rating. Still, if that company is a significant client of another of the bank's branches, that analyst could risk losing his or her job over a particular stock's rating.

However, when armed with the right tools, investors can dissect and pinpoint where these analysts could be coming from when finding the correct assumptions backing certain stocks. Three stocks being boosted by analysts today do have relatively straightforward fundamental tailwinds to back these forecasts. More than that, today’s business cycle is the biggest reason to look into these ratings.

Inside this list, investors can find The Home Depot Inc. (NYSE: HD) riding on the same tailwinds in the real estate sector that even Warren Buffett caught up to when buying homebuilding stocks last year. Then, United States Steel Co. (NYSE: X) is a secondary play within the same storm. Alcoa Co. (NYSE: AA) also comes in to deliver another way to ride on the next step in the business cycle.

Analysts Predict Home Depot Stock to Surge with Housing Cycle Boost

Recently, U.S. home listings rose after a sluggish start to the year. After stocks like Zillow Group Inc. (NASDAQ: Z) rallied in recent weeks, the value chain looks to advance toward the home improvement sector, where Home Depot dominates.

As of Q1 2024, statistics show that Home Depot controls over 61% of the home improvement industry’s market share. Because of this positioning, investors should take new price targets more seriously than if there weren’t other fundamental reasons.

Those at TD Cowen saw it fit to boost Home Depot stock’s price target to $420 a share, daring it to rally by 22% from where it trades today. Now that markets realize these new home listings could turn into new improvement projects for investors to finance, bearish traders have started to back away from Home Depot stock.

Over the past month, short interest dropped by 1.6%, showing that bullish sentiment could be building for Home Depot stock based on these analyst boosts.

How a Commodity Rally Shaped United States Steel's Latest Price Target

Steel prices are now back to pre-COVID levels, which will help the construction and infrastructure trends that also helped boost Home Depot’s valuations. Here’s how investors can break down United States Steel’s future to justify recent price target boosts.

The Federal Reserve (the Fed) is looking to cut interest rates later this year, which could be bearish for the U.S. Dollar. A weaker Dollar makes American exports more attractive to foreign buyers. Still, to export products, the manufacturing sector needs to produce.

New business activity will call on commodities like steel to address the ensuing demand. For this reason, analysts at BMO Capital Markets raised their price targets on United States Steel to $45 a share, or 19% above today’s price. That valuation is also close to Morgan Stanley’s $48 per share.

To ensure this thesis plays out, investors can keep up with the ISM manufacturing PMI index. When it starts expanding on these trends, United States Steel stock could be set to rally toward analyst targets. More than that, those at Goldman Sachs expect this same breakout, as written in the bank’s 2024 macro outlook report.

Analysts Connect the Dots: Double-Digit Upside for Alcoa Stock

Now, out of all the stocks riding on the potential boom in construction and infrastructure or the export demand that could come to prove Goldman Sachs right, Alcoa is the one analysts believe could deliver the most upside for investors savvy enough to look behind the scenes.

As the company makes aluminum products, which are exposed to construction, manufacturing, transportation, and consumer staples products, analysts felt even better about this stock moving forward. Those at Morgan Stanley and Citigroup shook hands to give Main Street more of the same.

These mutual valuations landed on a similar price of $50 a share for Alcoa stock. To prove these analysts right, the stock must rally by 25.6% from where it trades today.

Because aluminum prices have already rallied this year, demand may have already floated to that sector, making Alcoa a potentially attractive buy today. This is why the Vanguard Group raised its stake in Alcoa stock by 0.2% as of May 2024, bringing the asset manager’s net investment to $607.9 million today.

This eye-opening graph unlocks a trading secret (Ad)

Look, if you haven't seen your income grow at a rapid pace...

Or if you're tired of seeing the markets go higher and higher all while your retirement account has barely budged an inch...

You should know… It's not your fault.

Just as I have shown you, the majority of the time the stock market barely moves.

It's this kind of frustrating, whipsawing action that can demoralize a trader.

The truth of the matter is that… the odds ARE stacked against you.

And unless you come up with an edge in your trading…

Things will continue to be grim.

That's why I'm unveiling what I believe is the #1 way to flip the odds in your favor.

NVIDIA and TSM Stock: Is Semiconductor Sector Momentum Slowing?

The semiconductor sector has been a standout performer in 2024, but recent trends suggest that its momentum might be slowing. So, let's examine the overall state of the sector, focusing on the Van Eck Semiconductor ETF (NASDAQ: SMH) and two leading names: NVIDIA (NASDAQ: NVDA) and Taiwan Semiconductor Manufacturing Company (NYSE: TSM). By analyzing these names, we can better assess the current trend within the sector and the potential for further pullback and profit-taking.

The Semiconductor Sector: Key Insights and Current Trends

Year to date, the semiconductor sector has outperformed the overall market, primarily driven by the market giant and its top holding, NVDA. The sector ETF, SMH, has surged by almost 50% YTD despite falling nearly 7% in recent weeks from its 52-week high. The ETF is still above all major moving averages, but it's now consolidating below its 52-week high, hovering near its 20-day SMA, which is acting as short-term support.

If the ETF breaks below last week's support levels and the 20-day SMA, further declines might likely result in a sector-wide risk-off and profit-taking approach. Holdings in SMH have an aggregate rating of moderate buy based on 492 analyst ratings issued in the past year, covering 25 companies (99.9% of the portfolio). The ETF has an aggregate price target of $268.80, forecasting just over 3% upside.

To gain further insight into the overall direction of the sector, let's look at two of the top holdings of the ETF.

NVIDIA Analysts Remain Bullish: Moderate Buy Rating and Price Target

NVDA is the largest holding of SMH with an almost 25% weighting, meaning any significant directional movement in NVDA will impact the ETF and overall sector. NVDA has once again outperformed its sector and market this year, with the stock up a staggering 149% YTD, despite recently pulling back from its ATH and 52-week high by 12.23%.

Given the company's impressive growth and dominance, <a ">analysts remain bullish, with a moderate buy rating and a price target forecasting an almost 2% upside.

From a technical analysis perspective, NVDA mirrors the SMH ETF. It has recently put in a possible lower high and is consolidating near its 20-day SMA. A move below last week's low and the 20-day SMA might result in further short-term declines, possibly moving towards its next support near $110 or its rising 50-day SMA.

Analysts Bullish on TSM: Moderate Buy Rating Despite Recent Pullback

TSM, like NVDA and SMH, has seen a recent pullback, falling almost 6% from its 52-week high and consolidating similarly. If TSM breaks below last week's support and lows, it would break its short-term uptrend, possibly moving towards $160 support or its rising 50-day SMA. TSM is the second-largest holding of the ETF with an almost 13% weighting. Analysts are bullish on the name with a moderate buy rating, but the consensus price target forecasts a slight downside of 0.1%.

Momentum Shifting? Technical Analysis of the Semiconductor Sector

From a technical analysis perspective, the positioning of the ETF and its leading names suggests that momentum might shift in the short term to favor a pullback toward short-term support levels. The recent consolidation patterns and critical support tests in SMH, NVDA, and TSM suggest potential declines if these supports are breached. Investors should watch these levels closely to gauge the sector's next move.

Look what happened to Gold during these dates (Ad)

Did you know gold has "hotspot dates" between December 12th - December 24th?

Meaning it's gone up on average during those dates for the past 34 YEARS!

Most people probably have no clue about these dates unless they have access to this former hedge fund manager's Data Mining Software….

As you can see, it would have alerted you ahead of time that gold was gearing up for a big move between these dates.

Palo Alto Networks Stock Gains AI-Powered Cybersecurity Solutions

Network cybersecurity provider Palo Alto Networks Inc. (NASDAQ: PANW) stock has recovered from its fiscal Q3 2024 earnings report. While the results weren't bad, shares took a tumble on its forward guidance. However, the markets can smell a bargain when they see one, and shares have recovered to a 15% year-to-date (YTD) performance. The company integrates its proprietary artificial intelligence (AI) into its comprehensive suite of products and services.

Palo Alto Networks operates in the computer and technology sector, competing with cybersecurity companies like Crowdstrike Holdings Inc. (NASDAQ: CRWD), Zscaler Inc. (NASDAQ: ZS) and Sentinel One, Inc.(NYSE: S).

Precision AI is Integrated Into Palo Alto's Platform

Precision AI is Palo Alto’s proprietary AI that uses data gathered from the cloud, endpoint, and network to automate cybersecurity defense. Machine learning (ML) has been built into many of its products for over a decade. Its ML enables its security applications to predict, prevent, and remediate security problems. It uses deep learning to build predictive models that help to anticipate and detect security issues. Generative AI enhances tools to simplify user experience and summarize large volumes of threat intelligence in "human speak."

Palo Alto's Precision AI: Battling Adversarial AI Threats

Palo Alto's Precision AI contends with adversarial AI from bad actors. AI cuts both ways. Hackers are always trying to find new ways to exploit cybersecurity vulnerabilities. Cybercriminals are already implementing AI to accelerate, scale up, and improve existing attack methods like prompt injection attacks and phishing. Adversarial AI expands the attack surface, providing criminals with new vectors to target. The best defense is a good offense, pitting AI against AI.

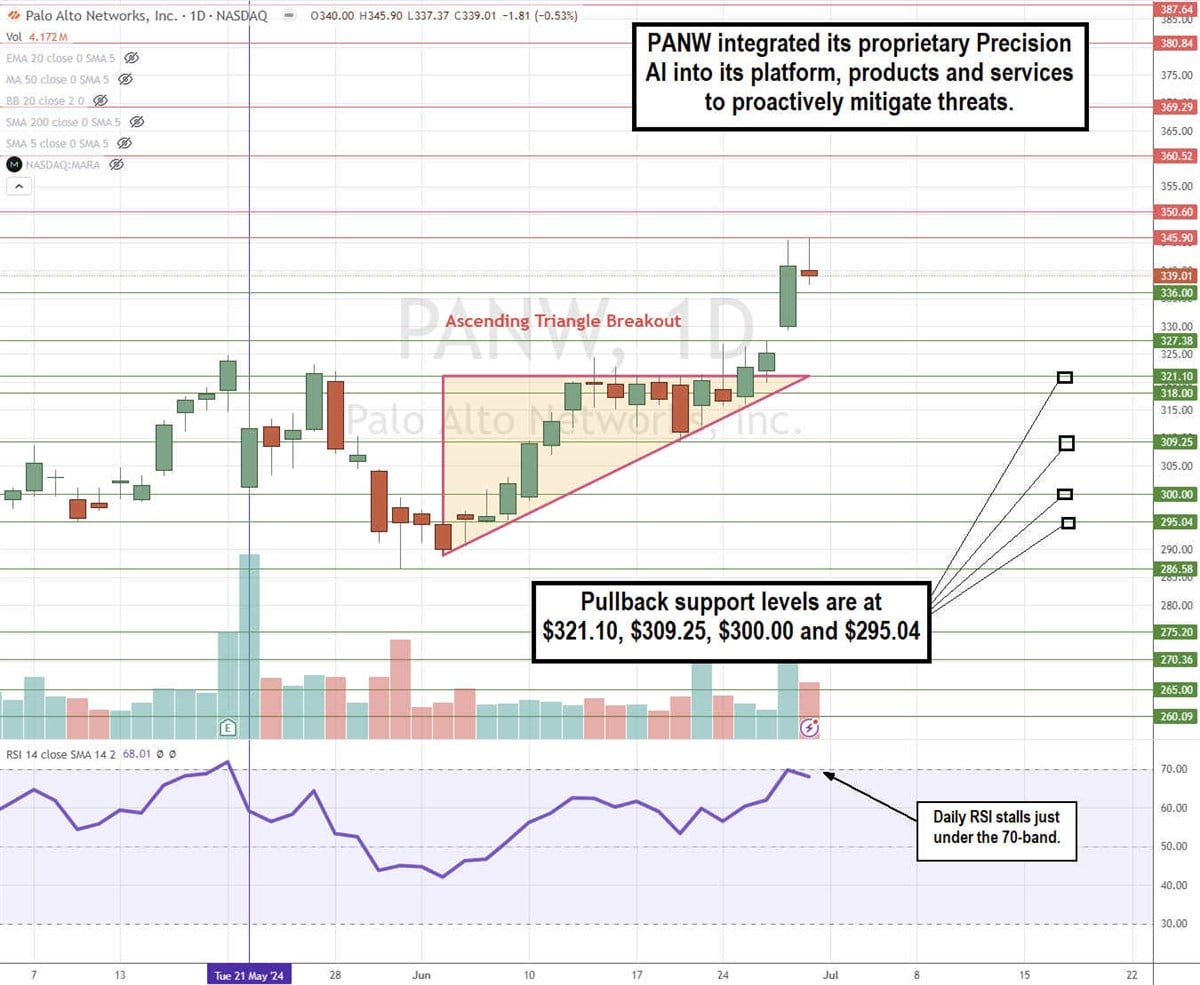

PANW Stock Triggered an Ascending Triangle Breakout

The daily candlestick chart for PANW illustrates an ascending triangle breakout pattern. The upper flat-top trendline held the resistance at $321.10, while the ascending trendline, comprised of higher lows on pullbacks, closed the distance. The breakout was triggered when PANW surged through $321.10 as shares climbed up to $345.90. The daily relative strength index (RSI) rose to the 70-band but hasn’t been able to pierce it yet. Pullback supports are at $321.10, $309.25, $300.00 and $295.04.

Palo Alto reported fiscal Q3 2024 EPS of $1.32, beating consensus analyst estimates by 7 cents. Revenues grew 15.1% YoY to $1.98 billion, beating $1.97 billion consensus estimates.

Platformization is Driving Growth

Platformization encourages customers to adopt a broader range of security solutions to build upon overall security infrastructure. This includes network security (NetSec) platforms with next-gen firewalls, a cloud security platform with Prisma Cloud, and endpoint security with Cortex XDR to secure endpoints. SecOps with security information and event management (SIEM) is like an "eye in the sky," providing a complete bird' s-eye view across the entire computer network. Palo Alto partnered with International Business Machines Co. (NYSE: IBM) to drive platformization.

Big Deals Continue to Grow for Palo Alto

In Q3 2024, the size of deals continued to grow, including an 8-figure deal with a financial services company expanding NetSec to Cortex. Palo Alto beat out more than ten cybersecurity vendors to secure a 9-figure deal with a healthcare provider consolidating NetSec and SecOps. Accounts generating more than $1 million rose 22% YoY to 397. Accounts generating over $5 million rose 17% YoY to 84. Accounts generating more than $10 million annually rose 28% to 32.

Palo Alto Issues In-Line Guidance

The company provides fiscal Q4 2024 EPS guidance of $1.40 to $1.42 versus $1.41 consensus estimates. Q4 revenues are expected to be between $2.15 and $2.17 billion versus $2.16 billion. Total billings for Q4 are expected to be between $3.43 billion and $3.48 billion, representing 9% to 10% YoY growth. Full-year 2024 billings guidance was narrowed to $10.13 billion to $10.18 billion, from the previous $10.10 billion to $10.20 billion. The billings guidance was responsible for the stock price gap the following morning.

Palo Alto Networks CEO Nikesh Arora commented, "We are pleased with the enthusiastic response to platformization from our customers in Q3. Platformization is a long-term strategy that addresses the increasing sophistication and volume of threats and the need for AI-infused security outcomes."

Palo Alto Networks analyst ratings and price targets are at MarketBeat.

Never buy a dividend stock without following this rule (Ad)

Jack Carter just released a free presentation you don't want to miss:

How to Build a Dividend Portfolio with 3 Golden Rules

These rules are critical if you want a rock solid, cash generating portfolio. Like this first one…

Rule 1: Yield-to-Growth Ratio…

And you'll be able to learn all 3 golden rules for this type of portfolio during the presentation.

没有评论:

发表评论