| Welcome! In this free e-letter, I’ll show you where the big money is headed in the markets so you can follow it to profits. And we love to hear from our subscribers… Tell us what you like, what you hate, and how we can make Palm Beach Insider the best free e-letter on following Wall Street to profits right here. | My System Still Works in a Recession By Jason Bodner, editor, Palm Beach Insider If you’ve been following me in these dispatches, you know I’m an optimistic guy… However, I also know that fear and negativity sell more than hope and positivity. Sadly, it’s human nature. And the media take advantage of it. They know fear-based headlines attract more viewers, listeners, and readers. We’re definitely seeing that with the coronavirus pandemic. The media keeps us in constant fear with their morbid death counts from the disease. They focus on everything that’s going wrong during this pandemic – but pay little heed to what’s going right. So it’s no wonder I’ve gotten messages like this from concerned readers like Alex C.: Hello, Jason… Most analysts predict national GDP will contract 20–30% because of social distancing and high unemployment through the second quarter. How will your “unbeatable” stock-picking system work if that happens? Of course, the analysts could be wrong. But if we buy your stock picks before the second-quarter numbers are released and the above scenario plays out… what will happen if there’s a recession? I know I’m not the only one concerned about this. Thanks. First, thanks for your question, Alex. Fortunately, our marketing research suggests PBRG readers don’t respond to doomsday scenarios like those of other financial newsletters and the mainstream press. That means you’re now part of a sophisticated group of investors. So welcome aboard. You made the right decision. Now, as I mentioned above, I’m an optimistic guy. But I don’t let my emotions dictate my actions when it comes to the markets. Instead, I follow the data. And today, I’ll share with you what it’s saying – and what it means for investors like you… How We Handle Volatility Since you’re a subscriber, Alex, you know I used my experience of nearly two decades at prestigious Wall Street firms – trading more than $1 billion worth of stock for major clients – to create an “unbeatable” stock-picking system. For those not familiar with it, here’s how it works… It scans nearly 5,500 stocks every day, using algorithms to rank each one for strength. But it doesn’t just look at individual stocks. It also tracks big-money buying and selling in the broad market through its market timing indicator, the Big-Money Index (BMI). And on January 17, it warned a major pullback was coming. A little over a month later, the S&P 500 had its biggest – and fastest – crash in history. From February 19 to March 23, it dropped nearly 34%. Now, how did I advise my readers to handle the impending volatility? I told them to consider booking wins if they were sitting on some gains. In my Palm Beach Trader service, we sold winners and raised 40% cash before the pandemic started to crater the markets. But here’s the thing… Not only did my system nearly nail the market’s March bottom, it also predicted the subsequent rally. Since then, the S&P 500 has rebounded over 26%. During this reset, we redeployed our cash to buy high-quality stocks at extreme discounts. For instance, on March 18, my system detected big-money buying on Veeva Systems (VEEV). We scooped it up in Palm Beach Trader at a discount. And the stock’s now up over 50% in under two months. [Note: VEEV is now above our buy-up-to price, so we don’t recommend initiating a position.] So if the system indicates another pullback, we’ll reduce risk by selling more winners and raising more cash. And when it tells us it’s time to get in again, we’ll buy more winners like VEEV at huge discounts. But what’s it telling us to do now? High-Quality Companies Thrive… No Matter What

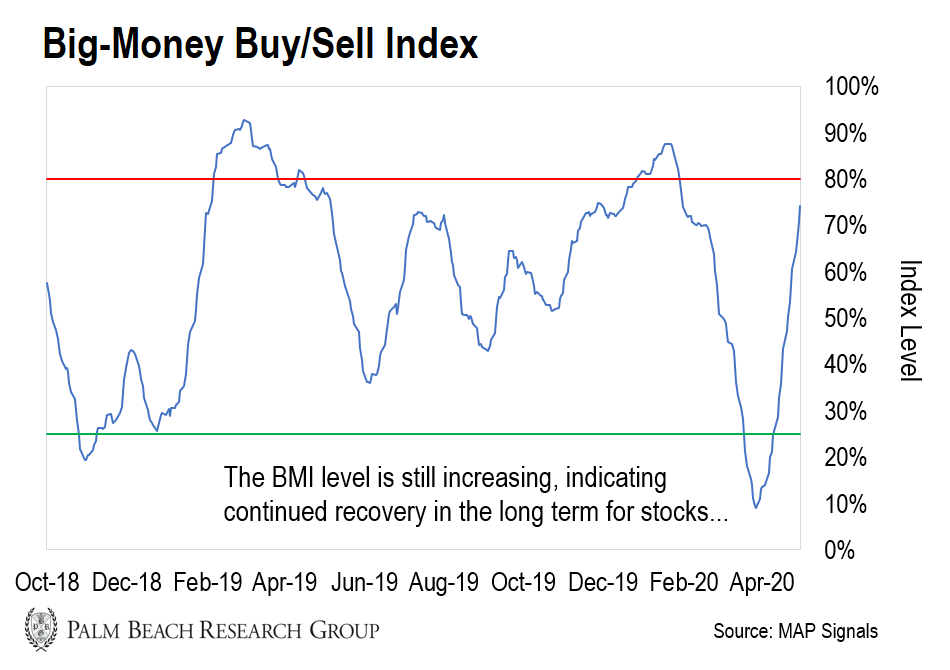

Right now, the index level is still increasing…

When it hits 80% (the red line in the chart) or more, it means buyers are in control and markets are overbought. And when it dips to 25% (the green line) or lower, sellers have taken the reins, leading the markets into oversold territory. Based on the current reading of 74%, we’ll likely hit overbought levels next week. (But this is due to the absence of selling and not big-money buying.) And when that happens, we’ll see another short-term pullback. However, this is all part of the current volatility. In the long term, the market will stabilize and recover as the big money starts flooding in again. Remember, my BMI data is so accurate, it forecasted nine market moves during this pandemic-related sell-off – including the March 23 bottom almost to the day… and the over 26% rally since then. Of course, data can change. And if it does, we’ll continue to do what we’ve always done: follow the big money. Again, if the big money starts to sell everything, we’ll reduce risk and raise cash again. And when my system says it’s time to get back in, we’ll buy high-quality stocks. So I won’t get concerned until my data tells me so – like it did in January. To wrap up, Alex, let me say this… Even if GDP takes a monster hit and a recession persists, there will be high-quality businesses that thrive and lead. And the big money will find these outliers. Since my system is expertly designed to follow its lead… it’ll continue to work, regardless of market conditions. Patience and process! Jason Bodner

Editor, Palm Beach Insider P.S. As I mentioned, my system follows the big money’s lead in all market conditions. And it’ll continue to identify winners like VEEV, no matter which direction the market’s headed in next. So learn how you can access my system’s data right here. It’ll help you unlock massive profits during this huge money-making market reset.

Like what you’re reading? Send us your thoughts by clicking here. IN CASE YOU MISSED IT… BUY… BUY… BUY… (Tiny $0.02 Crypto) On Wednesday, May 6, the independently ranked #1 most trusted person in cryptocurrency, has agreed to share how to learn the name of his new #1 pick with you. (His last top pick returned a peak open gain of 151,323%.) Click here to RSVP.

Get Instant Access Click to read these free reports and automatically sign up for daily research. |

没有评论:

发表评论