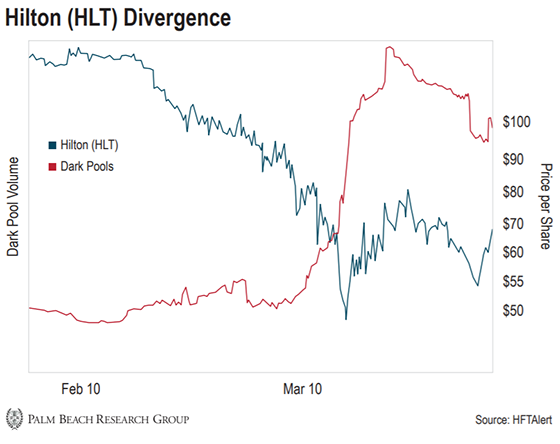

| By Chaka Ferguson, managing editor, Palm Beach Daily No matter what you think of President Trump, he’s on to something… We generally don’t speak about politics in the Daily. Our focus is helping subscribers make life-changing gains. And that’s our goal, no matter who’s in office. But President Trump put a spotlight on a topic that we’ve been investigating for months. And it’s the shady, fake news cycle coming out of Wall Street. Here’s what the president tweeted last month: When the so-called “rich guys” speak negatively about the market, you must always remember that some are betting big against it, and make a lot of money if it goes down. Then they go positive, get big publicity, and make it going up. They get you both ways. Barely legal? You see, powerful investors and bankers will say one thing in the media… but do the exact opposite with their money. But what President Trump didn’t tweet about is how these money men are pulling it off. Let me show you with an example… | Recommended Link | | SHOCKING WALL STREET REVELATIONS IN THIS VIDEO… I’m going to show you how to use this data as a lie detector… Because what’s happening right now is Wall Street is silently siphoning away billions of dollars in pure profits FROM YOU. Right now, I’m going to show you exactly how that’s happening… How you can protect yourself from Wall Street’s lies… And how you can get ahead of these people. Now, I want to make sure everyone gets something out of my appearance tonight… So, later in this broadcast, I’ll share with you the names of 2 widely held stocks Wall Street is lying to you about. That my lie detector is flashing red on these ticker symbols now. It’s clearly telling you Wall Street is lying to you about them. – Hedge fund legend Teeka Tiwari, being interviewed by Fernando Cruz | | | -- | Wall Street Double Talk On March 18, legendary investor Bill Ackman appeared on CNBC in prime time. He had a powerful message for Main Street: “Hilton is going to zero.” Ackman warned that shares of the hotel chain and its peers could soon be worthless because of the coronavirus lockdowns. “Tech Royalties” could be the answer to a fruitful retirement Now, a warning like that is enough to spook most investors into selling. Yet Wall Street was loading up on Hilton (HLT) in its “dark pools,” or private exchanges. You see, in 2007, the Securities and Exchange Commission opened a loophole for Wall Street when it updated its rules on electronic trading. It started off small, but now, 40% of all trading volume happens in these private exchanges. This loophole allows Wall Street to make huge trades away from the public spotlight. You won’t find them on the New York Stock Exchange ticker tape or in your broker’s stock charts. The day before Ackman’s appearance, trading volume for Hilton on these private exchanges was 13 times higher than average. And it was all out of public sight. | Recommended Link | | Facebook's founder never saw this coming… When Facebook’s mega-billionaire sat down before Congress on October 23… For over six hours of grueling testimony about his company's plans for a digital currency called Libra… He surely never imagined that one of the panel's top-ranking Republicans, Rep. James F. Hill of Arkansas, would be giving him incredibly lucrative advice. But he did – with a tip that could ultimately be worth millions to lots of regular American investors. Don't worry if you missed it. | | | -- | Take a look at this chart:

The red line shows the hidden dark pools. And the blue line shows HLT’s share price. As you can see, Wall Street was snapping up shares on public exchanges. Meanwhile, ordinary investors were dumping shares on the public markets. Urgent: Cell Phone Owners Beware Of course, we can’t prove that Bill Ackman was the one buying all these shares. And he’s denied accusations that he tried to drive down the market. But his fund, Pershing Square Capital, bought up millions of shares during this period. What if you had known ahead of time? You could have made a killing off this trade like the Wall Street elite. | Recommended Link | | The American Mining Boom Inside this map is the largest discovery of lithium in American history. Tesla could be on the verge of signing a billion-dollar deal for this lithium. | | | -- | Don’t Get Angry – Get Even Over the past three months, Daily editor Teeka Tiwari and his team have been studying this little-known data feed used by big institutional investors. Teeka had his team compare this hidden data set against public statements from high-profile people, to see if it confirmed – or refuted – what they said. What he discovered was shocking… I noticed something was off in early April. At first, I thought it was just statistical noise. But I wanted to be sure, so I tasked my team to dig into the data… The first round of reviews didn’t reveal much. So I told them to dig even deeper… And that’s when we discovered an additional source of trading data little used by individual investors. Heck, it was even little used by me – and I ran money professionally for years. This data completely rewrote our traditional data sets. That’s profound, considering some of our pricing data goes back centuries. After digging deeper, the team’s findings were disturbing… Until recently, I had no reliable way to catch these inconsistencies in the dark pools. On the surface, their statements were lining up with what I was seeing on the charts. It wasn’t until I discovered this data set little used by individual investors that I was then able to put all the pieces together. What I discovered was this data made up 40% of the trading in stocks. But that 40% is NOT reflected in the charts and data feeds you and I rely on. Now, Teeka says you can spend your time getting angry at Wall Street for being greedy. But as he puts it, that’s “like being angry at a rattlesnake for being a rattlesnake.” The best way to get even is to turn the tables on Wall Street. That’s why Teeka has spent months developing a system to track these private data feeds. It’s like a lie detector. And it offers the chance for investors to make an average of $19,740 on each trade. Last Thursday, he revealed the details of his new system to over 12,000 viewers. But time is running out to watch the official replay of his special webinar. It’s going offline tonight at midnight. So click here to watch it, before it’s closed for good… Regards, Chaka Ferguson

Managing Editor, Palm Beach Daily

Like what you’re reading? Send us your thoughts by clicking here. IN CASE YOU MISSED IT… Silicon Valley Genius Makes Next Big Tech Prediction Angel investor Jeff Brown has put his money into 130 tech startups… And he’s profited on 93% of them. In three of the last four years, he picked the No. 1 Tech Stock on the S&P 500… before it went up. Now, he’s found a new opportunity. A company that makes the tiny device critical to every single new 5G phone. Apple is expected to release their phone on or around September 22. When they do, shares in this tiny devicemaker could soar. Find out all the details before it’s too late.

Get Instant Access Click to read these free reports and automatically sign up for daily research. |

没有评论:

发表评论