$48,117. That's the increase in my High-Yield Investing portfolio over the past 12 months. In the October 2020 issue, the balance stood at $106,250. As I'm writing this, we're looking at a value of $151,373. That's a 12-month return of about 45%.

The market has provided a nice tailwind over this time frame, with the benchmark S&P 500 gaining 35.7%. I'm happy to say we've matched that return and then some - outrunning the market by nearly 1,000 basis points.

That won't always be the case. Considering we don't invest in growth stocks like Apple or Google (and have a sizeable allocation of municipal bonds, preferreds, and other fixed-income securities), the S&P 500 isn't the best yardstick to measure our performance. In fact, only five of my 45 active holdings are S&P members.

| | | The WORST move you can make when investing | | | | Often the worst thing you can do when it comes to investing... is doing NOTHING. Let's face it, your money doesn't simply multiply under your mattress... and a "savings" account paying near zero interest isn't going to get you any closer to retirement. But there is a better way. Right now, you can unlock access to a unique advisory with the potential to hand you lightning-quick payouts of $2,327… $2,628… even $3,435… month after month. Interested? Get the full story here. | | | |

|

The yield on this popular basket of stocks has sunk to 1.25%. So out of necessity, I must look outside its borders for high-yield portfolio candidates. That generally means small/mid-cap territory, where richer payouts of 4% or higher are more plentiful.

Your average investor has never heard of the stocks, funds, and other securities we talk about in High-Yield Investing. They don't get a lot of coverage in the mainstream financial media. But that's fine with me. While behemoths like Wal-Mart are closely scrutinized by Wall Street analysts, smaller businesses are less followed and more lightly traded - a combination that leaves many quality stocks trading at steep discounts to fair value.

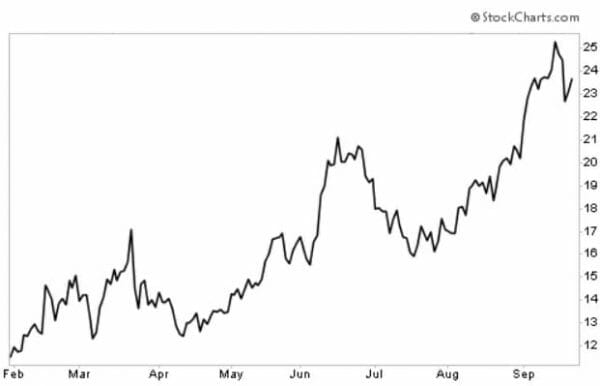

Coincidentally, the aforementioned October 2020 issue was a clarion call for investing in small caps. Since then, this overlooked corner of the market has shined. At the same time, a long-overdue rotation into value has also worked in our favor and bolstered performance. At the intersection of these trends lies stocks like the global shipping company I profiled, which has doubled since we pounced on it last January.

I've already recycled some of these gains, which have given our High-Yield Investing portfolio greater income-producing capacity. For illustrative purposes, let's suppose I deposited the entire $154,367 in a one-year bank CD paying the national average of 0.17%. At that rate, we would earn about $262 per year - or a whopping $22 per month. Add another zero to the principal, and even c would earn just $220 per month… barely enough for a trip to the grocery store.

Our mission is to help your money work harder. How much harder? Well, for the first time I've decided to assemble that information in a spreadsheet. Here are the total dividend distributions (or "paychecks") we can expect to receive over the next 30 days.

Holding |

# shares |

Expected Div. or Int. Payment |

Total Distribution |

| Energy midstream |

272 |

$0.27 |

$73.44 |

| Commercial REIT |

40 |

$0.24 |

$9.60 |

| Energy MLP |

89 |

$0.45 |

$40.05 |

| Big Pharma |

75 |

$0.39 |

$29.25 |

| Energy giant |

50 |

$0.43 |

$21.50 |

| Ag mortgage company |

50 |

$0.88 |

$44.00 |

| Datacenter REIT |

25 |

$1.27 |

$31.75 |

| BDC |

115 |

$0.21 |

$24.15 |

| Casino REIT |

100 |

$0.33 |

$33.00 |

| Mortgage insurer |

50 |

$0.36 |

$18.00 |

| Fast-food conglomerate |

60 |

$0.53 |

$31.80 |

| Hotel preferred stock |

100 |

$0.41 |

$41.00 |

| Mortgage REIT |

100 |

$0.62 |

$62.00 |

| Energy/MLP fund |

150 |

$0.18 |

$27.00 |

| Shipping preferred stock |

186 |

$0.55 |

$102.30 |

| Oil & gas midstream |

75 |

$0.94 |

$70.50 |

| Covered call fund |

100 |

$0.13 |

$13.00 |

| Dividend fund |

150 |

$0.11 |

$16.50 |

| Real asset fund |

100 |

$0.10 |

$10.00 |

| Enhanced income fund |

300 |

$0.05 |

$15.00 |

| Premium dividend fund |

142 |

$0.10 |

$14.20 |

| Healthcare fund |

100 |

$0.11 |

$11.00 |

| Muni bond fund |

150 |

$0.05 |

$7.50 |

| Commodities fund |

300 |

$0.04 |

$12.00 |

| Emerging markets fund |

45 |

$0.64 |

$28.80 |

| Utilities fund |

100 |

$0.12 |

$12.00 |

| Canadian telecom |

100 |

$0.72 |

$72.00 |

Total | | |

$871.34 |

I don't bring all this up to brag. The point is that even in this historically low-yield environment, we will still collect a healthy $871 next month. That's roughly 40 times more than the income from a bank CD.

The average retired worker collects a $1,553.68 check each month from Social Security, according to the Social Security Administration. So that's already 50% more each month right there, for a total of $2,424.68. That could get the job done in retirement, depending on your situation.

But the good news is this... When most of my High-Yield Investing readers retire, they're sitting on a bigger portfolio than $154,367.

Let's say you add a zero back on to our portfolio size again. At $1.54 million, you're looking at $8,710 per month. That's more than enough for most of us.

Regardless of where you're at, this should be proof-positive that you don't necessarily need to reach for risky "growth" stocks to make up for lost time. A stable of quality dividend payers can make you rich over time.

And that's where my latest report comes in...

I've handpicked 5 of my absolute favorite dividend payers for a very special purpose. Each one of these is what I consider to be "bulletproof" - meaning you can build your portfolio around them, sleep well at night, and watch the income roll in year after year.

If you'd like to get their names, go here now.

没有评论:

发表评论