Good day to you! According to the National Association of Realtors, what percent of US homes sold in September were on the market for less than a month? a. 46%, b. 66%, c. 86%. Follow the 🌊 below for the answer. Today we cover these trending money topics:

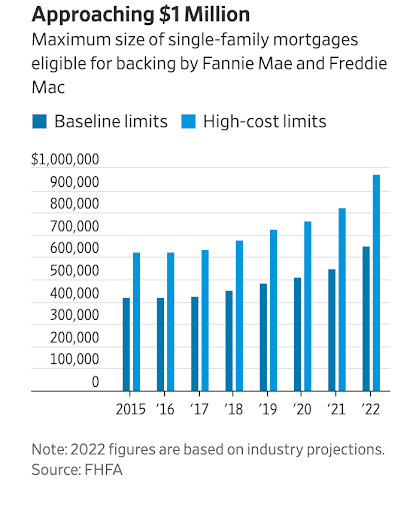

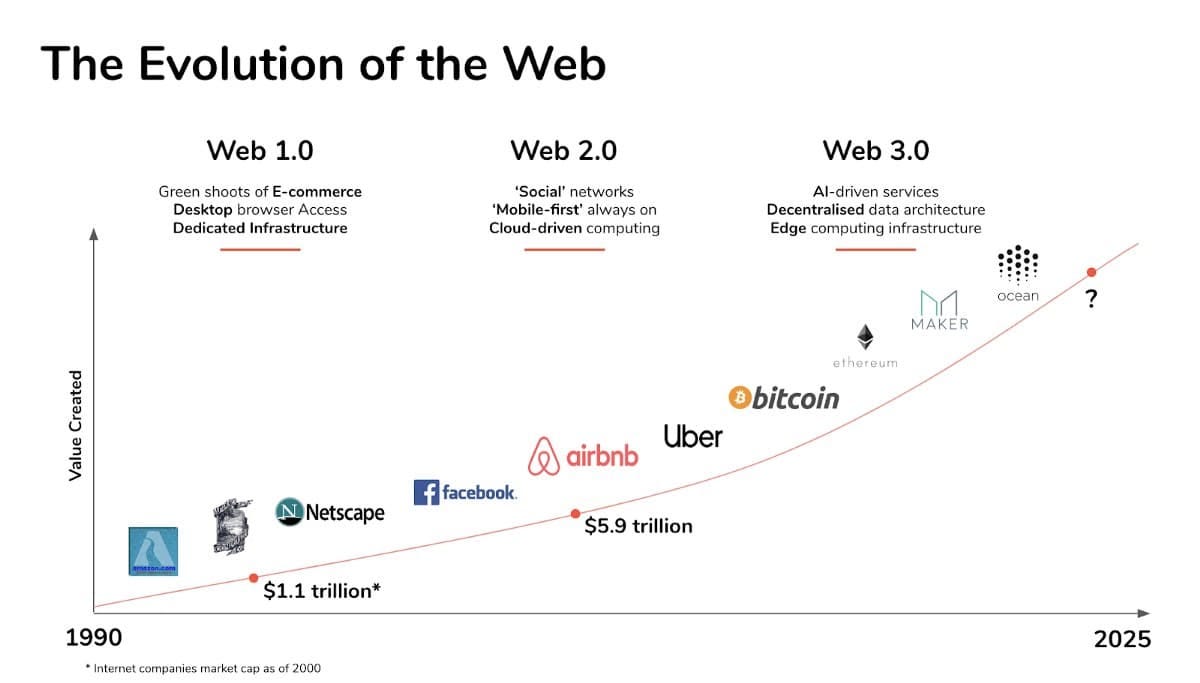

HOUSING MARKETThe government wants your $1 million dollar mortgageDid you know that about 50% of US mortgages are backed by a GSE (Government Sponsored Enterprise) of some kind? Whether it be FHA, VA, USDA or plain ole’ Fannie Mae or Freddie Mac, there's no doubt that federal backing plays a huge role in the US housing market. In 2022 though, the total value of loans under their supervision could increase noticeably as the cap on mortgage balances is being forced upwards with rising home prices. The logistics Even though it might seem like the government has access to limitless money and can easily jump-start the figurative money printer at any given time, they still have parameters on the size of mortgage these organizations can back. The limit for 2022 now sits at around $647,200 for mortgages in “most” parts of the country, with the flexibility to extend all the way to $970,800 in “higher-cost” markets. Yes, the federal government will now back mortgage loans of nearly $1 million. However, housing prices have been on the rise, subtly nudging the MBS (mortgage-backed securities) market to jump—getting GSEs to ask “how high?” The new $1 million ceiling These limits are adjusted annually, as one could argue they should be to account for housing price increases. And the following year could bring more of a buoyant spike, as housing prices have been rising at record rates—up 16% at the end of Q3 vs. the prior year to $363,700. These adjustments come at a time when these agencies' market share has been growing substantively too, with Fannie and Freddie now having a hand in over 57% of new mortgages in 2021, compared to 42% in 2019. The bigger picture This increase to the one million dollar mark by these agencies could make it cheaper and easier for some borrowers to buy a home. But with that, some may beg the question, how much of a role should the government be playing in our mortgage industry, and how much is too much to back? 🔎 Take this quiz-based microlesson if you want to zoom in on some mortgage basics: FUTURE TECHWhat is Web3 & why it mattersTechnological advancements are happening all the time, and at an increasingly faster rate as our innovations compound upon one another. One of those technologies on the rise is the concept of web3—the impacts of which could be far-reaching, not only for investors but a new and better future internet. The idea behind web3

Source—Fabric Ventures

Future implications Web3 elicits a more democratic internet where the governance structure is one of mutual ownership and there's no risk of being blocked or denied access to services. NFTs as a marketplace of digital assets and creative expression is an example that the movement towards web3 has begun. But only pieces of web3 exist today and much more needs to be done to build and scale the technology behind the aspirational vision. Just as we've seen companies readying for web3, like Coinbase, rise to power, there's no doubt we'll see similar trajectories for companies with vested interests in this area of technology. While it is an entirely new frontier that would take some studying to truly understand, it could present a promising opportunity even in today's traditional markets. 💡 Related companies and funds: Blockchain ETFs, such as Global X Blockchain ETF ($BKCH), Siren Nasdaq NexGen Economy ETF ($BLCN), Amplify Transformational Data Sharing ETF ($BLOK), and companies such as Coinbase ($COIN) SPONSORED BY DOLLAR FLIGHT CLUBTravel more for lessDreaming of your next adventure? Try Dollar Flight Club for just $1 if you sign up in the next 12 hours. Their 1 million members save 90% on round-trip flights. Don't miss out on deals like Hawaii from $111, business class to London from $839 and many more. Find your next perfect spot for $1 today. TAXESLast call: tax breaks before they're goneThe number one tax loophole? Don’t make any money. Oh right, that’s probably not a good idea. Okay, the second best tax break has to be making less money then, right? Close, the key is actually to just look like you did. As deceptive as that sounds, it’s an entirely legal thing to do, and the IRS is openly inviting us to reduce our taxable income every year. It’s literally written into the tax code on purpose. With this in mind, tax breaks are also transitory sometimes and need to be eaten while hot. Pandemic-related tax breaks that are expiring:

🤔 Want to review what's tax-deductible and what's not? Put your skills to the test: 📊 ASHU'S CORPORATE CORNERToday's Movers & Shakers

This commentary is as of 8:41 am PDT. 🌊 TRENDING ON FINNY & BEYOND

That’s it for today. Enjoy the rest of the week. The Finny Team If you liked this post from The Gist by Finny¹, why not share it? 1 Finny is a personal finance education start-up offering game-based personalized financial education, a supportive discussion forum, and simple stock and fund tools. Our mission is to make learning about all things money fun and easy! The Gist is Finny's newsletter to our community members who are looking to make and save more money, protect their finances and be their own bosses! Finny does not offer investment or stock advice. The Gist is sent twice a week (Tues & Thurs). The editorial team: Austin Payne and Chihee Kim. Thanks to Ashu Singh for Today's Movers & Shakers. *Sponsors or advertisers offer unique consumer services. We're thankful for their sponsorship to enable Finny to offer free financial education. Here's our advertiser disclosure. If you have any feedback for us or are interested in sponsoring The Gist, please send us an email to feedback@askfinny.com. |

2021年11月30日星期二

🕸️ A better future internet is approaching. It's called web3.

订阅:

博文评论 (Atom)

没有评论:

发表评论