You are receiving this email because you signed up to receive emails from True Market Insiders, rebranding to Sector Edge. Unsubscribe here Keep the emails you value from falling into your spam folder. Whitelist True Market Insiders. Forgot your login information? Click here.  Weekly Market Update Today is Jan. 29, 2022

Hey TMI Subscriber, The great sector rotation continues to gain momentum with investors piling money into defensive/cyclical sectors and stocks.

Specifically, appeal has picked up for more traditional, sector-based ETFs.

Thus far in 2022, Financial Select Sector SPDR (XLF), has hauled in $2 billion in assets, while SPDR GOLD (GLD) saw its largest one-day inflow in US dollars–$1.6 billion–a week ago Friday.

That's after GLD suffered its biggest annual outflow in nearly a decade in 2021.

If you're looking to take profits from or cut losses from your tech and growth stocks (like many investors are and should be doing) it makes sense to follow the money into these other sectors.

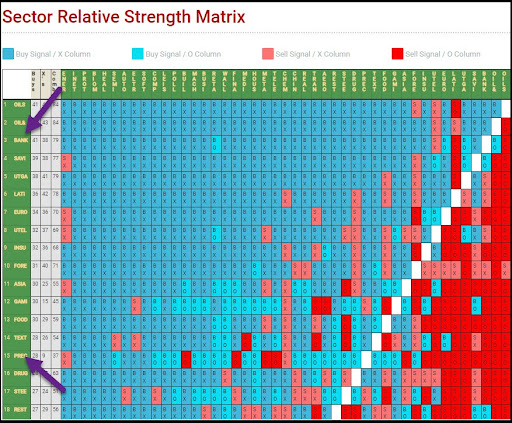

And, sure enough, our Sector Relative Strength Matrix that monitors 45 sectors on our Sector Prophets Pro proprietary data platform, shows that Banks (a subsector of Financials) is ranked #3, and Precious Metals is ranked #15.

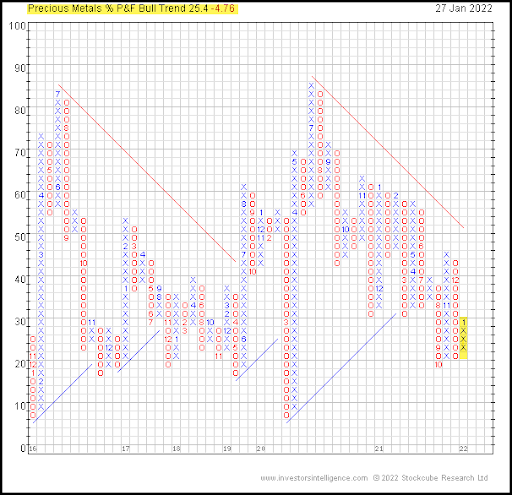

Furthermore, the Banks and Precious Metals sectors are each on bull confirmed status on their Bullish Percent Index (BPI) charts.

This means that demand is in control over the short term.

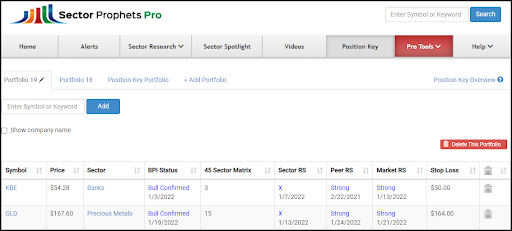

Within Banks and Precious Metals, two ETFs pass all the technical tests as shown on our SPP Position Key: SPDR S&P Bank ETF (KBE), and SPDR Gold Shares (GLD).

ETFs can be the perfect pitstop for assets you want to put to work until you find strong individual stocks within those sectors.

Or, if one continues to show strong relative strength, stick with it.

Right now, it's important that you take some defensive measures. So, why not look for the brightest stars in an otherwise dark sky?

Finally, if you're considering cryptocurrencies as a replacement for Gold – an investor's favorite hedge – check out Chris Rowe's new video by clicking here.

He's joined by a hand-picked expert who will tell you how to put crypto to work in your portfolio.

This Week in True Market Insider Jan. 25 - Jan. 28, 2022 Micro-Cap Monday: Check Out This Undervalued Dividend-Paying Micro — Bill Spencer

With the bears in control of 87% of the sectors, pickings are slim, but not in the Utilities Gas sector, where Bill Spencer found one company sure to warm up your portfolio in an otherwise cold investment climate. Technical Tuesday: Three Reasons This Is Scarier Than The COVID Crash — Chris Rowe

Here's a word of warning from Chris Rowe: What should scare you more than the current market crash is not having a plan for when the market hits the bottom (which he says it will). Are You 'Chasing Nickels Around Dollar Bills?' — Tim Fortier

Tim Fortier wants you to know about an old expression, "chasing nickels around dollar bills." It's a metaphor for focusing on the small details that really don't matter while ignoring what's really important. It also applies to investing. Find out why. Legally Profit From the World's Most Shady Investors — Costas Bocelli

What if you knew two days before a multi-billion-dollar takeover bid was made for a big box retailer that options traders were buying nearly $2 million worth of the stock? Well, Costas Bocelli did. If My Son and I Can Profit From This, You Can Too — Karen Riccio

Like many investors, Karen Riccio used to consider options trading to be "off limits." That's certainly not the case for her 24-year-old son who "learned by doing." Now, she's encouraging other investors to embrace his strategy. Related Articles Copyright © 2021 True Market Insiders, All rights reserved. DISCLAIMER

|

2022年1月29日星期六

Two ETFs For Today's Climate

订阅:

博文评论 (Atom)

没有评论:

发表评论