The chart above shows that this ratio dips from time to time. Are we about to enjoy one of those periods?

Nope.

As to our nation’s debt and its spending, here’s the Committee for a Responsible Federal Budget:

President Biden proposes spending nearly $7.3 trillion in Fiscal Year (FY) 2025, or 24.8 percent of Gross Domestic Product (GDP), under his latest budget.

In nominal dollars, this would be the largest amount ever spent – exceeding even COVID-era levels.

As a share of GDP, spending would be larger than any time in history outside of World War II and the COVID-19 pandemic.

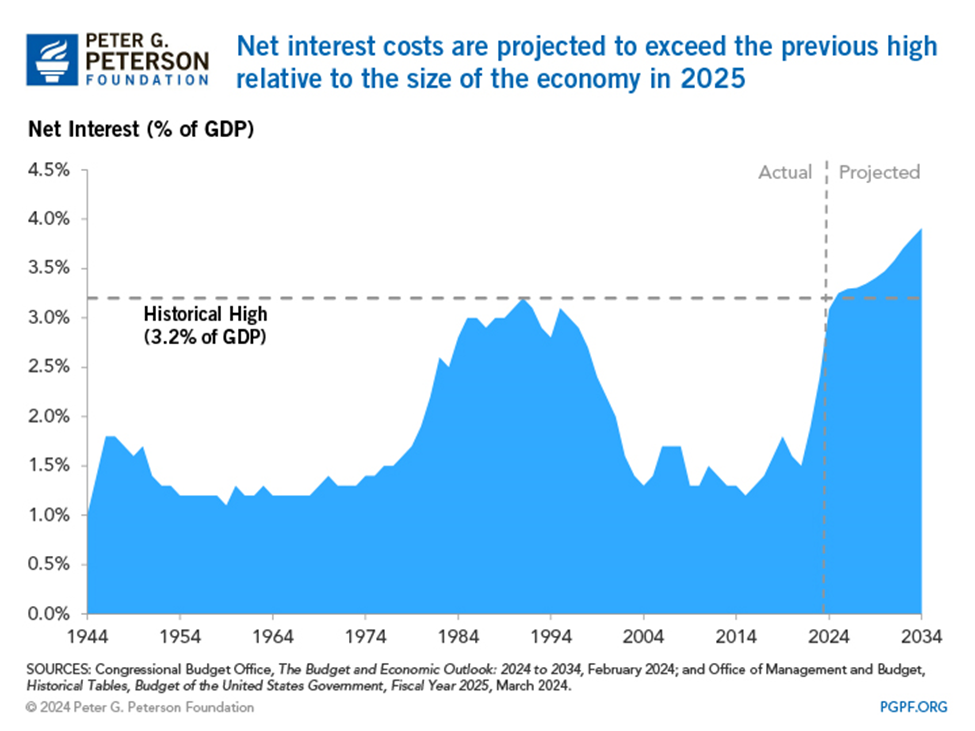

And as for the money spent on interest payments servicing the nation’s ballooning debt, here’s the non-partisan thinktank, the Peter G. Peterson Foundation:

Due to the recent rise in interest rates, as well as the mounting public debt, interest payments have grown rapidly over the past two years, and they are projected to continue growing.

The Congressional Budget Office (CBO) projects that interest costs will exceed their previous high relative to the size of the economy, reaching 3.2 percent of GDP ($951 billion) in 2025.

Clearly, “as long as it stays around where it is” is a pipedream.

Okay, but what about Yellen’s reference to “the real interest cost of the debt. That’s really what the burden is”?

First to make sure we’re all on the same page, why is this soaring interest cost such a big deal?

Here’s CBS News with the answer:

The problem…is that the nation's mounting debt and interest payments could eventually squeeze federal spending, making it harder to fund core programs like Social Security or to invest in initiatives that drive economic growth, such as infrastructure or education.

“Interest is projected this year to be the second-largest federal program — it means your tax dollars are going to interest instead of going to everything else," said Marc Goldwein, senior policy director at the Committee for a Responsible Federal Budget, a bipartisan think tank.

So, what’s happening with this “burden,” as Yellen put it?

Here’s the Visual Capitalist:

The cost of paying for America’s national debt crossed the $1 trillion dollar mark in 2023, driven by high interest rates and a record $34 trillion mountain of debt.

Over the last decade, U.S. debt interest payments have more than doubled amid vast government spending during the pandemic crisis.

As debt payments continue to soar, the Congressional Budget Office (CBO) reported that debt servicing costs surpassed defense spending for the first time ever this year.

Source: Visual Capitalist

Hmmm…

Clearly, Yellen must know something about the longer-term trajectory of U.S. debt and its debt service payments

It’s bound to crash, right?

After all, Yellen just said we’ll be fine as long as things remain roughly where they are today. It would be foolish of her to make that comment if there were easily accessible projections showing the exact opposite dynamic will likely occur, right?

[Insert awkward cough.]

From the Congressional Budget Office’s Long-Term Budget Outlook: 2024 to 2054:

The deficit increases significantly in relation to gross domestic product (GDP) over the next 30 years, reaching 8.5 percent of GDP in 2054.

That growth results from rising interest costs and large and sustained primary deficits, which exclude net outlays for interest.

So, I’ll leave it to you to decide…

Is Janet Yellen a fantastic gaslighter, or just fantastically uninformed?

ADVERTISEMENT

Maybe you’ve seen Goldman Sachs’s forecast that the $15.7 trillion AI revolution will impact 300 million jobs. But Elon Musk’s “AI 2.0” is already forcing organizations to ramp up those estimates. Now McKinsey analysts say it could leave 800 million unemployed, as Wired.com says 70% of occupations could be replaced. Where could you and your family stand in all this?

Get details here

Regardless of your answer, you and I need to do all we can to protect our wealth from what’s coming

On that note, let’s go to Charles Sizemore, Chief Investment Strategist at our corporate affiliate, The Freeport Society:

We’re living in an absurd world where the U.S. debt has skyrocketed to nearly $35 trillion, with over $175 trillion in unfunded liabilities…

Personal and corporate debts are at historical highs…

Yet Congress keeps spending billions on questionable initiatives.

In just 2021 alone, the Fed printed a mind-boggling $5 trillion – more than six times the total printed from 1776 to 1979!

We’re carrying this on our backs like this is normal.

Let me assure you, we should be crying. We’re in the grand finale of an unprecedented economic and social experiment. It’s an Age of Chaos unlike anything America has faced before.

Volatility will go wild. Some sectors, industries, and companies will boom while others go bust… stock prices will defy all the odds in either direction.

To push back against this chaos, Charles just partnered with a top fintech firm to develop what they’re calling the Comprehensive Hedging and Algorithmic Optimal Strategies system – the C.H.A.O.S. Cash System for short.

Here’s Charles describing it:

It’s designed to provide at least a $5,000 monthly income – whether the Dow Jones is partying or snoozing. And you’ll find it hard to invest another way again…

But be warned, this isn’t your typical passive strategy of buying McDonald’s (MCD) or Coca-Cola (KO) stocks for dividends or to hold and hope.

The C.H.A.O.S. Cash System takes an active approach in targeting a hidden group of stocks that 99.9% of retail investors ignore.

You can watch Charles’ free presentation on our nation’s financial situation and his response to it – the C.H.A.O.S. Cash System – right here.

Coming full circle, don’t expect the gaslighting from our leaders to stop

Why be honest when being honest isn’t likely to get you reelected (or reappointed)?

Unfortunately, as Ayn Rand said:

We can ignore reality, but we cannot ignore the consequences of ignoring reality.

Here’s Charles to take us out:

In these unprecedented times of soaring debts and political unrest heading into pivotal elections, ensuring your wealth is protected has never been more vital. The C.H.A.O.S. Cash System aims to be the lifeline you need.

Click here to watch the presentation I put together.

Have a good evening,

Jeff Remsburg

没有评论:

发表评论