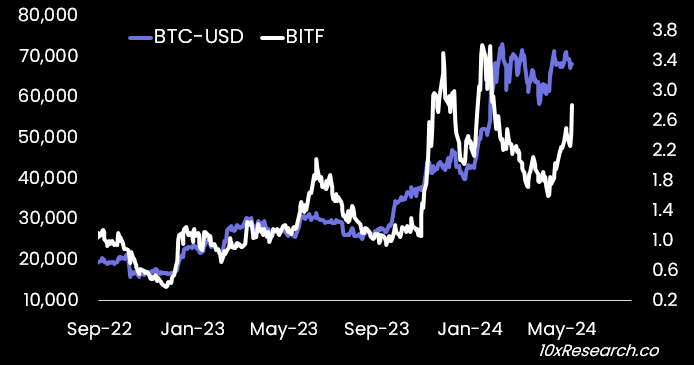

Does your crypto card offer no rewards? KAST’s early adopter program gives 3-9% rewards on spending. 10X subscribers though, get up to a 3X multiplier taking rewards to 27%! EXCLUSIVE OFFER: Join the waitlist & use campaign code “10X”When we see the code, we’ll fast-track you to onboarding. Be quick—the early adopter program has limited spots, and phase 1 entry closes June 21st. Taking Profit on Bitcoin Miners: Bitfarms +25% in just two weeks👇1-12) In our strategy report, ‘Bitcoin Mining Wars Are Heating Up—How to Play it?', we identified Bitfarms as the prime beneficiary of the ongoing consolidation within the Bitcoin mining industry. Since our report’s publication date, Bitfarms shares have surged by +25%. Other favorites, like Bitdeer (+61%), have also seen significant gains—all within two weeks. Bitcoin (purple) vs. Bitfarms (white) - the gap is closing. 👇2-12) We suggest caution. Bitcoin saw a slight decline of -1% during those two weeks and failed to break above the 71,946 resistance level. Although mining stocks, which are crucial takeover targets like Bitfarms, could rally further, we prefer exposure when there is a bullish underlying trend in Bitcoin. This is not currently the case, with the self-reinforcing Bitcoin mechanism generating less liquidity in February / March (see our webinar). 👇3-12) Despite MicroStrategy announcing another potential $500m bond offering to buy more Bitcoins, the market reaction is relatively muted – contrary to Q4 2023 and Q1 2024, when those announcements caused a euphoric rise in retail speculation, a rising funding rate, and so on. 👇4-12) Some mining stocks have benefited from US presidential candidate Trump's positive comments about US-based Bitcoin mining. At the same time, another tailwind might be repurposing the mining facilities into AI data centers. So, our call to take profit could be premature. 👇5-12) However, the hash rate has declined, and miners appear to offload larger than usual Bitcoins to fund their operations. This seems less bullish for the Bitcoin mining industry overall. 👇6-12) The probability was high that Bitcoin would break above the near horizontal resistance level at 71,946. A break above a previous all-time resistance level often results in a parabolic move that is too valuable to miss. Hence, near the top of the range, traders should bet for a breakout scenario when other factors, like a potentially lower inflation report, could provide the macro cover and be bullish. Sign Up Here For More Bitcoin/Crypto Ideas👇7-12) This was the case last week and this week, but risk management and a sharp mind in evaluating the narrative are most important if Bitcoin fails to accelerate higher. The game is not about being right but making money when the stars are aligned and being able to bet again, as a favorable macro environment should remain a tailwind for risk assets—and Bitcoin. 👇8-12) The macro environment is straightforward. The US employment side is weakening, as last week’s non-farm payrolls part-time job number and the household survey revealed. With initial jobless claims rising considerably, the Fed needs to get ahead of a potential slowdown before a spiraling effect takes place. Inflation has peaked for the year and will likely slip below 3.0% during the next few months as the weakness in producer prices will lead to consumer prices. 👇9-12) This will likely lead Fed Chair Powell to prepare markets for a rate cut later in the year during the July FOMC meeting (July 31), a message that will be reinforced at the Jackson Hole Symposium (August 22-24) for a September rate cut (September 18). The macro environment is bullish—box ticked. 👇10-12) When a market continues to sell off at a specific level, it has less to do with events, narratives, or fundamentals. Instead, a large seller perceives prices to be overvalued at that level. This is the case with Bitcoin, which has failed five times above 70,000. Therefore, the November 2021 all-time high of nearly 70,000 is a level where long-term holders are willing to sell their Bitcoins, as they are the most likely candidates to cash out. 👇11-12) Three days ago, a wallet with 8,000 Bitcoins, originally paid $3,750 per BTC in 2018 and now worth $538m, became active after more than five years of dormancy. Another wallet moved 2,000 Bitcoins after being dormant for 14 years. There are 1.8m Bitcoins (worth $121bn) that have not been moved for over a decade, including potentially 1.1m BTC mined by Satoshi himself ($75bn). This is why we would also expect that most of the Mt. Gox holders will convert their BTC into fiat once they take possession of their BTC in October/November 2024. 👇12-12) As long as Bitcoin remains within this 60,000 to 70,000 consolidation period, traders should consider trading more tactically. We want to be more aggressive near the top of the range in anticipation of a breakout or at the bottom in the expectation that Bitcoin will rebound. In the middle of the range where we are now, it’s about risk management. To lock in some PnL, taking a +25% profit in Bitfarms might be advisable. Sign Up Here For More Bitcoin/Crypto IdeasYou're currently a free subscriber to 10x-Research. For the full experience, upgrade your subscription. |

2024年6月14日星期五

Taking Profit: +25% in just two weeks

订阅:

博文评论 (Atom)

没有评论:

发表评论