|  After soaring throughout most of the week, the stock market is back to trading sideways once again. But we don’t think this weakness will last – because in our view, the Federal Reserve will surely cut rates by September. And anticipation of that first Fed cut will lead stocks to rally strongly throughout the summer.

Indeed, we would be buyers on this dip because it seems a huge summer stock rally is on deck.

Not so sure? Just look at the data.

This week, we learned that, across the U.S. economy, inflation is once again in rapid decline.

In May, core consumer price inflation dropped to its lowest level since 2021. Supercore consumer price inflation – core services excluding housing, considered the stickiest part of inflation – fell month-over-month for the first time since 2021. Not to mention, producer price inflation unexpectedly dropped, as did import price inflation.

After a bumpy start to the year, inflation is once again sustainably falling toward 2%.

Now, inflation is still running at 3%, and the Fed’s target is 2%. Conventional wisdom implies that the Fed will wait until inflation drops to 2% before it starts cutting rates. And at the current pace of disinflation, that could take until the end of the year.

So – why would the central bank cut by September, before inflation actually falls to 2%?

The labor market.

| | | | | SPONSORED  Forget about self-driving cars… rockets… or robots.

Elon’s new invention has been called his “most daring and disrupting project.”

Some of the best Venture Capitalists in the world are already invested in “Project Apollo.” Click here to see the details on what could be Elon’s next big thing | | | A Rocky Labor Market Suggests the Fed Will Cut Soon After all, the Fed has a dual mandate: stable prices and full employment. But the ‘full employment’ side of things is starting to look very shaky.

Last month, the unemployment rate rose to a fresh cycle-high of 4%. And this week, jobless claims rose to a nine-month high, suggesting the unemployment rate will rise even more in June.

Clearly, this labor market is cracking.

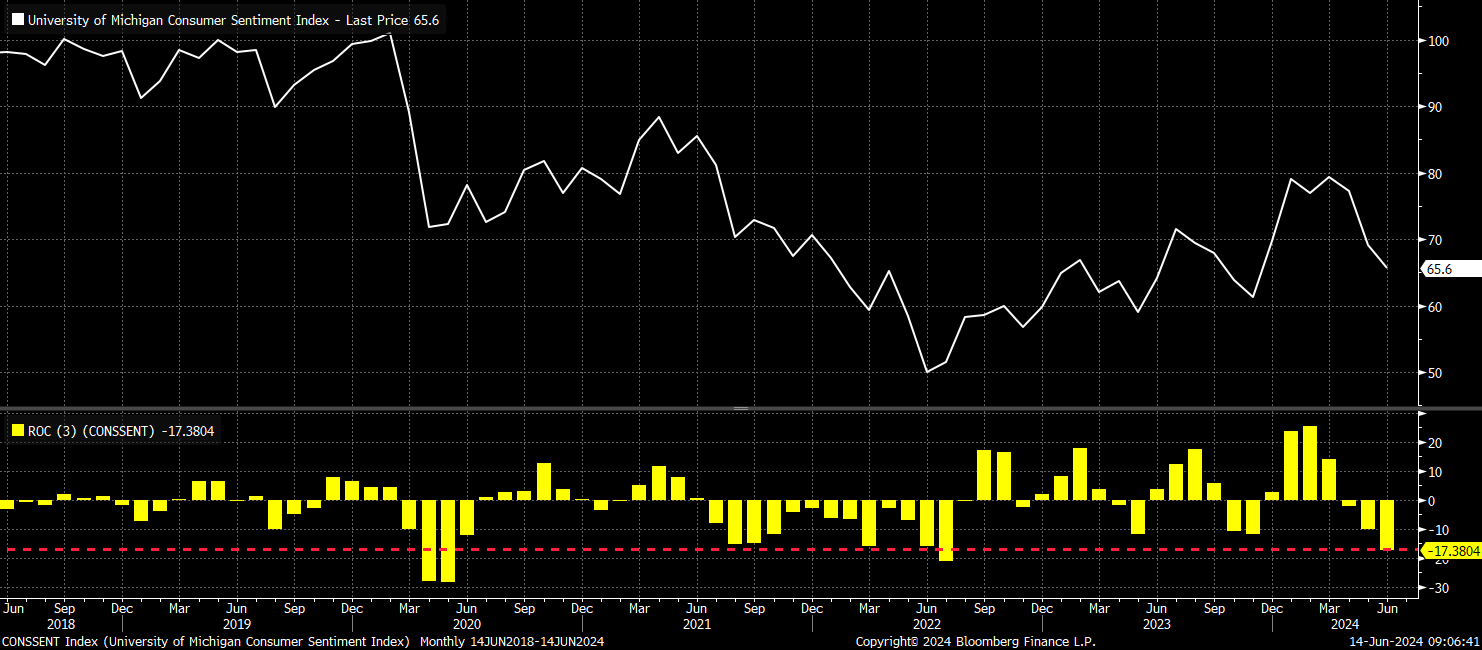

And today’s Consumer Sentiment Report from the University of Michigan suggests the cracks will deepen rapidly over the coming months. Consumer sentiment unexpectedly crashed to 65.6 in June, its lowest level since November ‘23. More worrisome, consumer sentiment is down 17% over the past three months. That’s its biggest three-month decline since summer 2022 and, before that, early 2020 at the onset of the COVID-19 pandemic.  In summer 2022, when consumer sentiment dropped this much over a three-month stretch, the Fed stopped hiking rates.

Similarly, after consumer sentiment plummeted in early 2020, the Fed cut rates.

Point being: During the past five years, whenever consumer sentiment has plunged this much over a three-month stretch, the Fed changed its policy stance.

And we think the same thing will happen this summer.

| | | SPONSORED  PayPal was not a popular idea at first.

In the late 1990s, when most people were still mailing checks, Elon Musk’s idea of making payments over the internet was unimaginable.

Now, though, PayPal is a promising contender in the ever-competitive AI boom.

It seems that everything Musk has done throughout his career sounded insane at first…

Which is why it’s important that you pay attention to his latest, strange invention.

It’s an AI device that could be the most powerful technology ever created.

This new idea is set to shock the world once again – and this time, you don’t want to be a nonbeliever. Click here to learn all the details | | |

The Final Word The incoming economic data leads us to believe that the labor market will continue to weaken. Inflation will continue to fall.

And both will happen much more quickly than the Fed anticipated – which will lead it to cut rates much sooner than anticipated, too.

That’s why we think the first rate cut is coming in September.

It’s likely that the market will increasingly come to that conclusion, too. As it does, stocks will soar ahead of what may be the most highly anticipated rate cut in the Fed’s history.

To prepare for that summer stock rally, we’re positioning our portfolios to potentially win big with top-notch AI stocks.

Learn about a few of the picks we’re recommending these days.

Get Ready for Gains Sincerely, |

没有评论:

发表评论