TickerTalk Headlines for July 3rd

In this newsletter:

Generac Holdings Stock: Mixed Signals Leave Investors Uncertain

Generac Holdings Inc. (NYSE: GNRC) has long been synonymous with backup power generation, holding a commanding presence in a market driven by the need for energy reliability. However, recent developments have created a complex narrative, leaving investors to decipher a mixture of positive and concerning signals. While institutional investors seem to be betting on the company's long-term potential, insider selling and a divided analyst community add a layer of uncertainty. Generac's ambitious move into the rapidly evolving energy storage sector further complicates this intricate picture.

Institutional Appetite for Generac Remains Strong

Despite some headwinds, Generac has attracted significant attention from institutional investors. Generac’s ownership data reveals that over the past year, numerous institutions have shown their confidence in the company by either initiating new positions or increasing their existing stakes in Generac.

This unwavering interest suggests a belief in the company's ability to generate long-term value, particularly as the demand for energy resilience solutions continues to rise. Several factors likely underpin this positive sentiment. Generac holds a dominant position in the backup power generation market, a sector expected to benefit from aging grid infrastructure and the increasing frequency of extreme weather events, both of which threaten power disruptions.

Energy Storage: Generac's Strategic Leap into a New Frontier

Generac’s acquisition of PowerPlay Battery Energy Storage Systems is a significant stride toward establishing a strong presence in the rapidly growing energy storage market. This strategic decision signifies the company’s ambition to evolve beyond its traditional stronghold of backup generators and position itself as a comprehensive energy solutions provider. By integrating PowerPlay's technology and expertise, Generac can tap into new revenue streams and cater to a broader customer base, including those actively seeking greater control over their energy consumption and resilience.

The potential of this acquisition is substantial. The energy storage market is projected to experience exponential growth in the coming years, driven by factors such as the increasing adoption of renewable energy sources, the need for grid stabilization, and a growing desire among consumers and businesses for energy independence.

However, the path to success in the energy storage sector has obstacles. Generac will face intense competition from established players and emerging startups, all vying for dominance in this lucrative market. Successfully integrating PowerPlay’s operations and technology into Generac's existing infrastructure will require seamless execution and a deep understanding of this evolving industry.

Analyst Perspectives on Generac

Despite the excitement surrounding the company’s move into energy storage, Generac’s analyst community remains divided on the company’s near-term prospects. This divergence of opinions is evident in the range of ratings assigned to Generac’s stock, from bullish “buy” recommendations to more cautious “hold” and even some bearish “sell” ratings. This lack of consensus is reflected in the target prices set by these analysts, which vary significantly.

Several factors contribute to this divided outlook. While showing modest revenue growth, Generac’s earnings reports have also revealed margin pressure, raising concerns about Generac's ability to maintain profitability while pursuing its growth strategy. Additionally, macroeconomic factors, such as inflation and potential recessionary pressures, have led some analysts to adopt a more cautious stance.

Further complicating the picture for investors is the recent trend of insider selling. Over the past year, several high-ranking executives, including CEO Aaron Jagdfeld, have sold considerable amounts of stock. Data reveals a pattern of consistent selling by Jagdfeld, who has sold 5,000 shares every month since January 2024, totaling 30,000 shares in the first half of the year. Adding to this, another insider, Patrick John Forsythe, sold a substantial 65,855 shares in May 2024 at an average price of $145.80, culminating in a transaction exceeding $9.6 million.

While it is important to note that insider selling is not always a definitive indicator of a company’s future performance and can be driven by personal financial decisions, the consistency, and volume of these transactions, particularly in light of other mixed signals, warrant scrutiny from investors.

Generac’s Fluctuating Stock Performance

Generac's stock is currently trading around $136 and has experienced its share of volatility, reflecting the uncertainty surrounding the company's future trajectory. The stock has fluctuated within a 52-week range of $79.86 to $156.95, illustrating its sensitivity to market sentiment, analyst pronouncements, and shifts in the broader economic landscape. Despite a respectable 3.03% gain since the start of the year, Generac’s stock has declined by 10.71% over the past year.

This volatility underscores the inherent risks and rewards associated with investing in a company undergoing a pivotal transformation. While promising, Generac's strategic expansion into energy storage carries uncertainty. Additionally, the cyclical nature of the energy industry and potential economic headwinds contribute to the unpredictable nature of Generac's stock price.

A Balanced Approach is Prudent for Generac

Generac Holdings presents a compelling investment case for those seeking exposure to the growing energy resilience market. Its dominant position in backup power generation, coupled with its strategic push into energy storage, positions it to capitalize on trends shaping the future of energy. This potential is further underscored by strong institutional investor interest and a healthy projected earnings growth rate of 30.89% for the coming year. However, investors must carefully weigh these opportunities against the company's inherent risks and uncertainties.

While open to interpretation, persistent insider selling raises valid concerns that should not be ignored. Additionally, divided analyst sentiment and the inherent volatility of Generac's stock price highlight the importance of conducting thorough due diligence and aligning investment decisions with individual risk tolerances and investment horizons. A measured and informed approach, considering the potential upsides and potential downsides, is essential before you decide to navigate the complexities of Generac Holdings as an investment opportunity.

New trading system called MSFT, NVDA & MSFT (Ad)

Look 2023 kind of sucked from a trading standpoint…

Despite the market finishing 24% higher….

Just seven stocks did all of the work…

Unless you were holding or actively trading those 7 stocks, your trading year probably wasn't as fruitful as you had hoped…

According to my research, my new trading system would have spotted all seven of the "Magnificent stocks" MONTHS before they reached the highs they are trading at today.

Analysts and Earnings Propel the S&P 500's Continuous Growth

The S&P 500 (NYSEARCA: SPY) can continue to climb its wall of worry because its foundation is built on earnings growth. The bricks are made from FOMC and inflation news bites, which sustain a low level but subsiding fear. The bricks may grow heavy enough to keep the market from rising more, or the wall may become top-heavy and lead to a crash, but that hasn’t happened yet. Because the June PCE price index aligns with an outlook for a soft landing and an eventual interest rate cut, the wall could grow until some other reason to worry emerges. The target today is the S&P 500 at 6,100.

Inflation and the FOMC: Analysts and Revisions Drive the S&P

The June PCE price index was a Goldilocks report, not too hot to inflame fear of inflation and not too cold to raise doubt about economic health. The takeaway is that the “new normal” put in place three years ago is still in place today and that inflation is cooling. In this environment, economic growth and earnings health are spotty but present and sufficient to offset weakness. This means that the S&P 500 returned to earnings growth last year; growth is accelerating in 2024 and is expected to accelerate in 2025.

Inflation is expected to continue cooling. The CME’s FedWatch Tool shows the market pricing in the first interest rate cut will come by November and that two will be possible by the year’s end. That will mark a real economic shift that will sustain, if not improve, the outlook for earnings. The risk with the earnings outlook is that the market is front-running. It will start looking to 2026 as soon as the fall, which could alter the outlook if earnings growth is forecasted to stagnate. Until then, analysts are raising their estimates for earnings and stock prices and leading the S&P 500 higher.

Big Tech and Mag Seven Lead a Concentrated Market

Big Tech and Magnificent Seven have led the market for the last few years and will continue to do so in the second half. Analysts are supportive and continue raising their estimates for these stocks because of their position in the AI industry.

Wedbush sees the S&P 500 rising another 15%. In their view, index growth will accelerate as expanding use cases for AI broadens the market for today’s AI leaders and leads to a broader rally in tech. The analysts' top two choices are NVIDIA (NASDAQ: NVDA) and Microsoft (NASDAQ: MSFT), which have emerged as the leaders in the enterprise AI industry, but most Mag Seven names are included in their forecast. Others, like Apple (NASDAQ: AAPL), are well-positioned to monetize AI while using it to widen margins. Productivity and automation will emerge as central themes.

NVIDIA, Microsoft, and Apple are the three largest components of the S&P 500, comprising 22% of the index, and their analysts are raising targets. Morgan Stanley is the latest to update on NVIDIA, and it has raised its estimates for earnings and share prices based on channel checks in Asia.

According to Morgan Stanley (NYSE: MS), demand for NVIDIA’s Hopper line remains robust and will sustain revenue and earnings power during the transition to Blackwell. That will be next year. Morgan Stanley’s new target is $144, a 20% gain from today’s level, and it is not the highest target issued. That belongs to Rosenblatt and is another 35% of upside. Likewise, Microsoft analysts are supporting its market and leading to the high end of their range, a 20% upside for its stock. Apple is forecasted to rise nearly 30% at the high end of its target range.

The S&P 500 Has Room to Run

The S&P 500 trades near a critical resistance point but will likely move higher soon. The rally is technically strong, the chart shows a budding buy signal, and earnings season is near. Microsoft and many Mag Seven names report mid-to-late July, while NVIDIA and many semiconductor stocks report later in August, so index results could create a new high and sustain a rally over the summer. Assuming the market sets a new high, the rally could last through year’s end. The technical target is 6,100 but may be surpassed because Wedbush’s target is closer to 6,250.

Biden to Launch "FedNOW" [Move Your Money Now] (Ad)

Earlier this year President Biden signed the death warrant for America…

Executive Order 14067 will essentially cancel your money.

You see Biden and the Fed have teamed up to create a controllable, traceable, programmable digital currency to replace the dollar...

CrowdStrike Stock Soars, Outpacing Palo Alto in Cybersecurity

CrowdStrike Holdings (NASDAQ: CRWD) is a technology firm specializing in AI-powered cybersecurity. It has recently seen massive share price growth, up 162% in the last 12 months. Since going public in 2019, the firm has had a total return of 573% and is now the 8th largest software company in the United States. This has caused the firm to be recently added to the S&P 500 Index. Let’s get an understanding of CrowdStrike’s products, its past financial results, and its outlook.

CrowdStrike’s AI-Powered Falcon Platform

CrowdStrike operates as one reportable segment. Its core offering is the Falcon platform. Falcon is a cloud-native software that uses AI to detect and prevent cyber threats. It helps create automated workflows that give information security teams the upper hand. Real-time analysis of trillions of weekly cybersecurity events prevents threats. Falcon offers 27 cloud modules. CrowdStrike emphasizes that the platform is "lightweight," allowing devices to run the software without impacting user productivity.

Falcon continually incorporates user data into its “Security Cloud” to improve its AI algorithms. CrowdStrike dubs this feature “cloud-scale AI." Along with its deep human cybersecurity expertise, it reduces mistakes in threat identification and response. CrowdStrike believes this combination of artificial and human intelligence is essential to stay ahead of increasingly more sophisticated attacks. Bad actors use AI to enhance their capabilities, so protection must also use AI. The prevalence of hybrid and remote work models makes cloud-native software like Falcon crucial. Customers pay for Falcon through a subscription model.

CrowdStrike’s customers include government organizations and private businesses. It has typically targeted larger firms, but it is now focusing its sales teams on small and medium-sized firms. It attracts these customers through a trial period model. CrowdStrike’s competitors include Microsoft (NASDAQ:MSFT), Palo Alto Networks (NASDAQ:PANW), and SentinelOne (NYSE:S).

CrowdStrike’s Stellar Financial Performance

CrowdStrike has posted extremely impressive results over the past several years. This includes a 30% compound annual growth rate in net income over the past three years. It currently has the highest net income margin and gross profit margin in its history. Compared to its sector, its gross income margin is in the 81st percentile. It has also decreased its total debt-to-equity ratio from 89% in 2021 to 31% today.

The firm highlighted some key metrics in its last earnings release. This includes a 33% increase in annual recurring revenue (ARR) from the previous year. ARR, derived from contractual obligations, offers revenue stability and demonstrates customer retention. This enhances the firm's earnings quality, leading to higher valuation multiples. New ARR, representing ARR added in the quarter, increased by 22%.

Another notable metric is the record free cash flow of $322 million, representing 35% of revenue. The firm now provides cybersecurity to 62 of the Fortune 100 companies and gained S&P 500 membership in a recent update. This adds to the firm's name recognition and legitimacy as a top-tier firm and will allow its shares to have increased demand due to index fund purchases.

CrowdStrike’s Outlook vs. Palo Alto Networks: Valuation, Margins, and Analyst Price Targets

Regarding valuation, margins, and financial ratios, the firm has some notable differences from its rival Palo Alto Networks. It trades at a substantially higher forward price-to-earnings multiple of 91x versus 58x for Palo Alto. Palo Alto also has a net income margin of 31%, nearly eight times higher than CrowdStrike. CrowdStrike maintains a current ratio over double that of Palo Alto and has expected earnings per share (EPS) growth over the next year, 400 basis points higher than Palo Alto. Based on these metrics, it's fair to wonder if CrowdStrike can justify its 62% higher earnings multiple versus Palo Alto.

Wall Street believes both firms are fairly valued, with the average price target for CrowdStrike implying a 1% downside versus a 4% downside for Palo Alto. Looking at EPS surprises, both firms may continue to beat expectations. EPS surprise measures the percentage difference between the consensus EPS estimate and actual EPS. Both firms have posted positive earnings surprises over the last 12 quarters. Over the past four quarters, CrowdStrike has posted an average earnings surprise of 16%, compared to 12% for Palo Alto.

Exposed: 3 CENT Crypto to Explode July 22nd? (Ad)

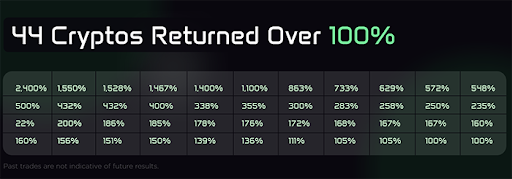

Chris Rowe – the man who recommended Amazon in 1998… Bitcoin and Ethereum in 2017…

And has spotted 44 different coins that have returned over 100%...

Today, he is now making the biggest crypto call of his ENTIRE career…

没有评论:

发表评论