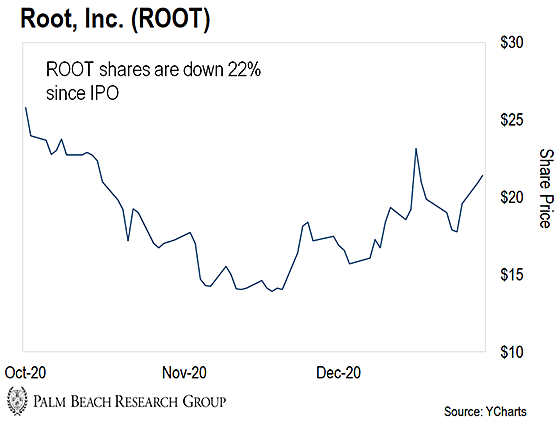

| By Chaka Ferguson, editorial director, Palm Beach Daily Last year, tech stock Root went public to much fanfare… As you may know, an initial public offering (IPO) is when a private company lists its stock on a public exchange to raise money for growth and expansion. And in 2020, Root looked like a prime IPO candidate. Analysts called the auto insurance company “disruptive.” Some said its technology would “revolutionize” how people shop for insurance rates. The company had its initial public offering (IPO) on October 28, 2020. After jumping out of the gate to $29 – shares quickly plummeted 9%. And it’s only gotten worse. Anyone who bought Root on IPO day and continued to hold until today is down more than 22%.

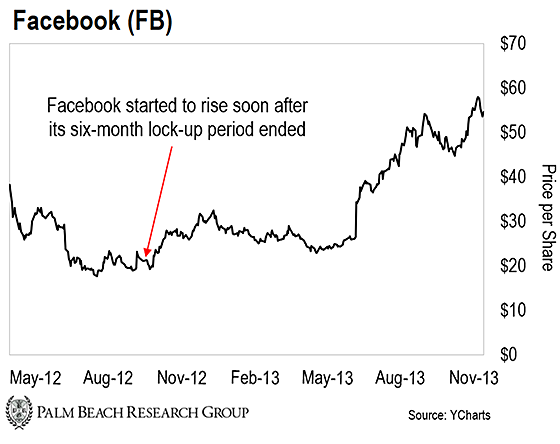

Here’s why I’m telling you this about Root… Everyone knows 2020 was the biggest IPO boom on record. More IPOs doubled in their debuts than in any year since the tech boom. And some of the biggest names to go public in 2020 were Airbnb, DoorDash, GoodRx, Palantir, Snowflake, and Warner Music Group. Since their debuts, these companies have returned an average of 78%. Those are solid numbers… But what most investors don’t know is this: It often pays to wait to buy an IPO. You see, private companies often go public with lots of hype… and they can surge by double-digits on IPO day. But those initial returns are usually wiped soon after as early investors pocket their windfalls. With 2021 shaping up to be an even bigger year for IPOs than 2020… many investors will jump headfirst into the next hyped-up names. (On tap this year are unicorns like Instacart, Petco, Coinbase, and Nextdoor.) Now, some of you may want to invest in these multibillion-dollar companies as soon as they go public. But quite often, it pays to wait… | Recommended Link | | 50¢ “Founder’s Shares” Could Be Yours If you’re reading this… You have a rare opportunity to get in on one of the most promising tech startups in Silicon Valley. A tiny tech company, founded by a former Google engineer. (He was an advisor to Google X – Google’s top-secret research laboratory.) Already, this company has received financial backing from at least eight venture capitalists. And today, you can get in for just 50¢ a share… the same price as the founder and CEO… This is truly a once-in-a-lifetime opportunity. Important: Space in this deal is strictly limited. To learn how to take part, please click the link above immediately. You may not have the chance to do so again. | | | -- | Don’t Buy the Hype Our general rule of thumb for IPOs is that you should wait if you can’t get an early allocation (more on that below). That’s because even if you’re not an insider, you’ll likely be able to buy the IPO at a discount a few months later. You see, there’s a little loophole that the average Joe can take advantage of. It’s called the “lock-up period.” When a company is private, a small number of insiders like company executives, employees, and venture capitalists can buy early shares. But they’re bound by a lock-up period (typically around six months) when the company goes public. During that time, they can’t sell their private shares. Since they’ve been holding their shares for usually five to 10 years… the market knows that once the lock-up period expires, insiders will sell a significant number of them the first chance they get. Obscure 81¢ Stock Could ‘Piggyback’ on $17 Trillion Industry? Take Facebook, for example… When the company went public on May 18, 2012, shares shot up to $45 on the first day. Early investors sold soon after… and shares bottomed just a few months later. But if you’d waited the full six months after the IPO, you could’ve gotten Facebook shares for around $18 – 60% below the IPO-day price. Today, Facebook trades above $250.

Of course, not all IPOs follow the same pattern as Facebook. But one thing holds true: If you wait, you’ll almost always have the chance to buy a stock at a cheaper price. But if you really want to make life-changing gains from companies going public – the kind insiders see – Palm Beach Daily editor Teeka Tiwari says you need to follow a different path. | Recommended Link | New Cure Sends Stock Soaring 802% It's a parent's worst nightmare. At just 13 months old, little Emma L. stopped crawling. The cause? A rare disease that cripples muscle. Just a few years ago, it would have been a death sentence. But then she received a new cure and began crawling again. Today, little Emma has a chance to walk. Soon after, shares of the company behind Emma's cure soared as much as 802%. There are 10,000 rare diseases like the one Emma had, with no known cure. But that's starting to change… And for investors, that represents 10,000 opportunities for triple-digit gains. | | | - | The “Blueprint Path” to IPO Riches Teeka says there are two paths investors can take when investing in IPOs. The “Blueprint” path and the “Hype Hole” path. Here’s Teeka… Most investors don’t know the difference between these two types of IPOs, so they constantly get lured down the Hype Hole path. And just like it sounds, Hype Hole IPOs can swallow your retirement dreams whole. So knowing the difference between the Hype Hole IPO path and the Blueprint IPO path can literally have you retired this year versus waiting another 20 years. So what’s the difference between the two? How To Retire Rich Off a Single “Boring” Stock Investors on the “Hype Hole” path buy companies on the day they go public. That’s when you see an initial price spike from all the “hype” surrounding its IPO. Hype Hole investors are usually buying at a premium because IPO shares often fall after the lock-up period. The Blueprint path is buying companies before they go public. That’s the path Wall Street elite and Silicon Valley insiders use to make their IPO fortunes. On this path, you can buy pre-IPO shares for pennies and then sell them for huge gains when they go public. In other words, you’ll be selling to investors buying the hype. For instance, Main Street investors made 31% when Amazon went public. But pre-IPO investors walked away with 9,165%. We saw the same thing with Google: An 18% gain for Main Street versus a 1,500,000% gain for private investors. And remember those big names from 2020: Airbnb, DoorDash, GoodRx, Palantir, Snowflake, and Warner Music Group? IPO day investors saw an average 78% gain from those companies. But investors who chose the Blueprint path have seen average gains of 2,796%. That’s the difference between turning every $1,000 into $1,780… or turning every $1,000 into $28,960. And it’s how you can achieve your financial freedom in a year. Now, finding the best deals on the Blueprint path isn’t easy. There are a lot of bad deals out there. It takes real research to separate the good from the bad. That’s why last week, Teeka held a special presentation to show you the difference between Hype Hole and Blueprint IPOs. Along with his free training, Teeka also unveiled how you can get access to his first-ever Blueprint pre-IPO tech deal. Shares are priced at just 50 cents each. So with a $500 grubstake, you’d own 1,000 shares. Look, IPOs are exciting, and you’ll hear plenty of stories about large, one-day gains. But don’t buy into the hype right away. You’ll likely end up overpaying for shares when the company goes public. Wait for the lock-up period to expire. Or even better, consider going the Blueprint path and buying pre-IPO shares. They’re a real game-changer for retail investors. Regards, Chaka Ferguson

Editorial Director, Palm Beach Daily P.S. You don’t want to delay on Teeka’s latest opportunity. You can get in this Blueprint path pre-IPO tech deal for 50 cents per share ($500 gets you 1,000 shares). But space in this pre-IPO deal is strictly limited by law. Click here to learn more…

Like what you’re reading? Send us your thoughts by clicking here. IN CASE YOU MISSED IT… NEW Gold Interview – Not Available on CNN, Fox, or MSNBC Legendary investor, Doug Casey, just made a MASSIVE gold prediction… It's so outrageous, we nearly refused to publish it. But then Doug agreed to fly 5,700 miles – from his ranch in Argentina to Aspen, Colorado – to explain everything in this exclusive interview. And what he told us left us all shocked… Our entire office is still talking about it. Doug calls it the “most bullish sign he's seen in 45 years”… And shares his #1 Gold Secret – LIVE on Camera. If you've been waiting to profit from this massive gold boom… Now is your chance. Watch the Interview Now (Doug's #1 Gold Secret Revealed).

Get Instant Access Click to read these free reports and automatically sign up for daily research. |

没有评论:

发表评论