Become a War Profiteer

Violence in the Middle East continues to escalate...

Over the weekend, three U.S. service members were killed in Jordan from a drone attack by an Iran-backed militia. At least 34 others were injured.

This is the first time U.S. troops have been killed in the Middle East conflict, which began back in October when Hamas attacked Israel.

It's a tragedy. There's no other way to say it...

In these Wednesday Health & Wealth Bulletin issues, though, we tend to focus on investing and markets. So we're going to put emotions and politics aside and do just that today... We'll turn to an asset that deserves your attention because of the chaos and carnage we are seeing all throughout the world.

We're talking about oil.

| Recommended Link: |

|

Multimillionaire Investor: 'Trade Places With Me'

A former $200 million hedge-fund manager who tripled his clients' money, has been called "The Prophet" by CNBC, and has met Warren Buffett and Presidents Obama, Clinton, and Biden... invites you to try a powerful new investment strategy you'd normally need $2 million to access. Learn more here. |  | |

The big opportunity from an investment perspective is that the war could spread and jeopardize oil supplies in the region, home to some of the world's largest producers. The top five oil producers in the Middle East are Saudi Arabia, Iraq, the United Arab Emirates, Iran, and Kuwait.

And the violence in Israel and the Gaza Strip has already spilled over into nearby countries... including attacks on commercial shipping. This alone could disrupt the production, distribution, and supply of oil.

If we see even more war – which, seeing how things are going in the world today, it's likely – the supply of oil could drop. And that would mean prices would increase.

War aside, it's clear that oil prices should rise from today's prices...

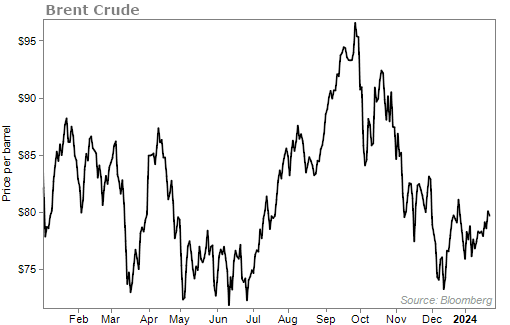

The chart below shows the price of Brent crude, the international standard for oil. Prices are hanging around $82, much lower than what we saw in September.

Prices have been dropping because of worries about a slowing economy. But we see many indicators that show these economic concerns are overblown.

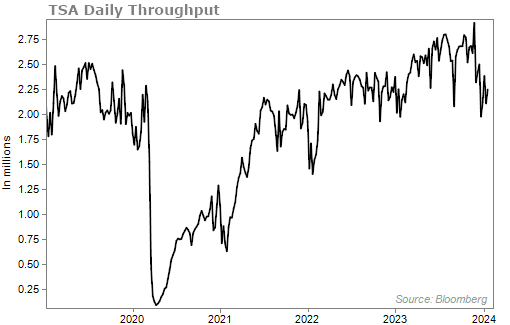

We're seeing restaurants with long wait times, folks on the road traveling, and crowded airports.

Here's the Transportation Security Administration ("TSA") data on daily passenger volumes... slightly higher than this time in 2020.

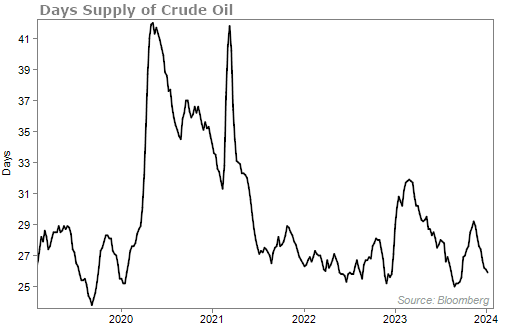

Turning to the supply side of the equation, we're still not producing enough oil to keep up with demand.

The chart below shows that if we stopped producing oil today, we'd have less than 26 days' worth of the commodity on hand. That's near the lowest level over the past five years...

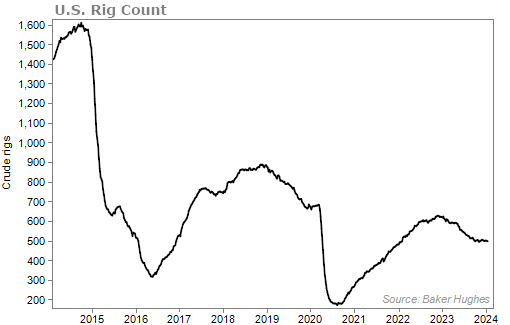

Another way to track oil supply is by looking at the below chart from oil-services firm Baker Hughes. It shows how many rotary rigs are active and drilling for oil.

As you'll see, the rig count has been on the rise ever since its collapse during the pandemic. But that has fallen off recently. It's still not past pre-pandemic levels yet, and it's well below levels seen in 2014. Take a look...

According to the U.S. Energy Information Administration, worldwide crude production will average 36.4 million barrels per day (b/d) in 2024 and 37.2 million b/d in 2025. That's less than the average in the years leading up to the pandemic of 40.2 million b/d.

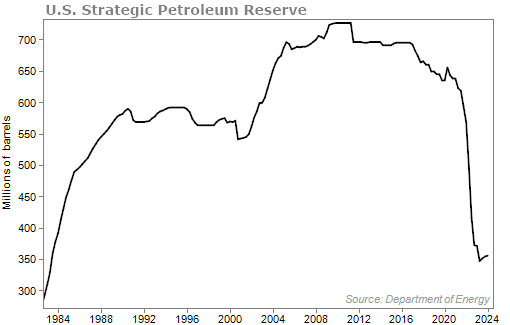

Finally, the Strategic Petroleum Reserve ("SPR") – the U.S.'s emergency oil stockpile – still needs to be refilled.

In response to Russia's invasion of Ukraine – when energy prices spiked – President Joe Biden decided to release oil from the SPR to stabilize prices... which he did at an unprecedented rate.

Total SPR capacity is 714 million barrels, and two years ago, it held about 600 million barrels. But after bottoming at 347 million barrels over the summer, inventories still sit at just 357 million barrels.

Now, the U.S. is buying millions of barrels of oil again. That steady demand will help push prices higher and protect against declines. After all, the reserves are just half full. It'll take years to rebuild this emergency oil supply.

Using a simple analysis – going back to basics with supply and demand – we see higher oil prices in the future. And if more war erupts throughout the world, prices could really take off.

It's a space we think investors need exposure in.

Finally, as a reminder, you're running out of days to hear our colleague Whitney Tilson's latest update involving his project to crush the market in the years to come. Whitney's message will only be around to listen to for a few more days...

Click here if you haven't heard from Whitney yet.

What We're Reading...

Here's to our health, wealth, and a great retirement,

Dr. David Eifrig and the Health & Wealth Bulletin Research Team

January 31, 2024

| Follow us on | |  | |  | |

没有评论:

发表评论