TickerTalk Headlines for June 22nd

In this newsletter:

McDonald's Stock: Balancing Value and Innovation

McDonald's Corporation (NYSE: MCD) is the global leader in the fast-service restaurant sector. It continues to draw attention from investors seeking exposure to companies acknowledged for brand recognition, expansive reach, and consistent dividend payments. Although McDonald’s stock performance has been lackluster, recent announcements and McDonald’s news headlines suggest the company might be about to start reaping the benefits of its strategy shifts.

McDonald's Navigates Market Changes with Value and Innovation

In response to evolving consumer preferences and a more competitive fast-food market, McDonald's has implemented several strategic initiatives to enhance its value proposition, drive customer traffic, and leverage technology to improve operational efficiency.

One notable initiative is the recent nationwide launch of the $5 Meal Deal, a move designed to attract budget-conscious consumers seeking affordability without sacrificing quality or convenience. The meal deal includes a choice of a McDouble or McChicken sandwich, small fries, a four-piece Chicken McNuggets, and a small soft drink, offering a compelling value proposition in an environment where consumers are increasingly discerning about their spending.

In contrast to its strategic emphasis on value, McDonald's recently discontinued its AI-powered drive-through test program. This decision followed nearly three years of testing in over 100 U.S. locations, where the AI system encountered challenges in consistently understanding and accurately fulfilling customer orders. While the decision to pause the AI drive-through rollout may be perceived as a setback, it highlights McDonald's commitment to delivering a seamless and positive customer experience, recognizing that current AI technology may not yet be sophisticated enough to meet the demands of its high-volume drive-through operations.

Assessing McDonald's Current Market Position

Despite reporting solid financial results in its Q1 2024 earnings report, McDonald's stock price has experienced fluctuations in recent weeks. According to data, McDonald’s has declined by 4.54% over the past month and 10.48% over the past three months. Year-to-date, the stock has retreated 14.41%, reflecting broader market uncertainties and investor concerns about consumer spending in the face of inflationary pressures.

However, despite the recent price pullback, the average analyst price target for MCD is $315.14, representing a 21.60% upside from its current price. This optimistic outlook from the McDonald’s analyst community is further supported by a consensus rating of "Moderate Buy," suggesting continued confidence in the company's long-term growth potential. Analyst estimates for earnings per share (EPS) for the current fiscal year range from $12.00 to $12.45, with an average estimate of $12.22, signaling an anticipated increase in profitability compared to the previous fiscal year.

The company has a long-standing track record of rewarding shareholders through dividends. McDonald’s dividend currently boasts a dividend yield of 2.58%, with an annual dividend payment of $6.68 per share. Over the past three years, McDonald's has increased its dividend at an annualized rate of 7.32%, demonstrating its commitment to returning value to shareholders and maintaining its status as a Dividend Aristocrat.

13 Quarters of Positive Sales: McDonald's Brand Strength

McDonald's earnings report, released on April 30th, 2024, demonstrated the company's resilience and ability to navigate a complex operating environment. Global comparable sales increased by 1.9% during the quarter, marking 13 consecutive quarters of positive comparable sales growth. This sustained growth underscores the enduring strength of the McDonald's brand and its ability to resonate with consumers across various economic cycles.

A closer look at comparable sales performance across different geographical segments provides further insight into McDonald's global reach and market dynamics. The U.S. market, a key driver of the company's overall revenue, reported a 2.5% increase in comparable sales, driven by strategic menu price increases, effective marketing campaigns, and continued growth in digital and delivery channels. The International Operated Markets segment, which includes major markets such as the U.K. and Germany, recorded a 2.7% increase in comparable sales, highlighting the company's success in adapting its menu and marketing strategies to local preferences.

The International Developmental Licensed Markets segment, which encompasses emerging markets and regions experiencing geopolitical instability, experienced a slight decline of 0.2% in comparable sales during the quarter. This decline was primarily attributed to the ongoing impact of the war in the Middle East, offsetting positive growth in other markets such as Japan, Latin America, and Europe.

McDonald's reported a total revenue of $6.17 billion in Q1 2024, representing a 5% increase compared to last year. This revenue growth was driven by a combination of higher comparable sales, strategic menu price adjustments, and continued expansion in certain markets. Operating income for the quarter reached $2.74 billion, an 8% increase year over year, reflecting the company's focus on cost management and operational efficiency.

Diluted earnings per share for Q1 2024 were $2.70, a 9% increase compared to the prior year. It is important to note that these results include the impact of restructuring charges related to the company's ongoing efforts to streamline operations and optimize its organizational structure. Excluding these charges, adjusted diluted earnings per share were $2.74, still demonstrating a healthy 2% increase year over year.

Market Adaptability: McDonald's Focus on Customer Engagement and Loyalty

McDonald's continues prioritizing initiatives designed to enhance customer loyalty and drive repeat business. The company's loyalty program, active in approximately 50 markets globally, has proven to be a significant success, with systemwide sales to loyalty members reaching nearly $25 billion over the trailing twelve months. This emphasis on customer engagement is crucial for McDonald's to maintain its market share and drive future revenue growth.

McDonald's continues to demonstrate its resilience and adaptability in a rapidly changing business environment. The company's solid Q1 2024 earnings, highlighted by 13 consecutive quarters of positive comparable sales growth, underscore the enduring strength of the McDonald's brand. While its stock price has experienced some volatility, reflecting broader market uncertainties and investor concerns about the impact of inflation on consumer spending, the company's focus on affordability, customer loyalty, and strategic innovation position it well for continued success in the ever-evolving fast-food industry.

Man who Predicted Trump 2016 Win: "Prepare for Election Meltdown" (Ad)

Former advisor to the CIA, the Pentagon and the White House Jim Rickards went on multiple TV news programs…

A predicted Trump would win.

You won't believe what he's predicting now.

Top 3 Home Builder Stocks: Key Insights into the Housing Market

The housing market in 2024 continues to be complex and volatile for homebuyers and investors. Interest rate volatility, affordability concerns, and persistent inflation present ongoing challenges for the industry. However, the demand for housing remains resilient, driven by favorable demographics and a chronic supply shortage.

To gain a deeper understanding of the housing market, investors often turn to earnings calls of leading homebuilders to gain insights into their performance, strategies, and outlook. Leading homebuilders adopt strategic approaches to maintain profitability and capitalize on growth opportunities. But what tactics are they currently employing to navigate market uncertainty? From land acquisition strategies to innovative construction methods, the answers may lie in the details of their financial reports and strategic initiatives.

KB Home: Capitalizing on Operational Improvements

KB Home (NYSE: KBH) is a national homebuilder known for its Built to Order business model. KB Home’s earnings report detailed solid results for the first two quarters of fiscal year 2024. The most recent financial results for KB Home highlighted a strong start to the spring selling season, with net orders increasing 55% year-over-year. KB Home attributed this performance to a combination of factors, including low housing inventory levels, solid employment, and a sustained desire for homeownership despite rising interest rates.

The company's Q2 2024 earnings call reinforced this positive trend. KB Home achieved revenue of $1.71 billion and diluted earnings per share of $2.15, representing an 11% increase compared to the same quarter last year. The company saw further growth in net orders, which rose 2% year-over-year, and a significant improvement in cancellation rates, reflecting increased buyer confidence and a stabilizing housing market.

KB Home's management emphasized the company's strategic focus on optimizing each asset on a community-by-community basis, aiming for an annualized average absorption pace of approximately five net orders per community per month. This strategy, combined with consistent land acquisition and development investments, is expected to support the company's projected revenue of $6.7 billion for the full fiscal year.

KB Home's management acknowledged the ongoing challenges of interest rate fluctuations and affordability concerns. The company has employed a strategic approach to pricing and mortgage concessions, offering rate buydowns and other incentives to support qualified buyers and maintain a competitive position. KB Home's operational efficiency has also improved, with construction cycle times compressed by over 30% compared to last year. This progress has been attributed to a focus on value engineering, simplification efforts, and stronger relationships with manufacturing and trade partners.

D.R. Horton: Leading the Market with Scale and Capital Efficiency

D.R. Horton (NYSE: DHI) is the largest homebuilder in the United States. D.R. Horton’s earnings report for the second quarter of 2024 revealed a robust financial performance, which management highlighted in the earnings call. The company achieved double-digit earnings growth, with earnings per diluted share increasing 29% to $3.52. Its consolidated revenue for the quarter was $9.1 billion, representing a 14% year-over-year increase. The company delivered 22,548 homes in the quarter, up 15% from the prior year.

D.R. Horton's management attributed the company's success to its industry-leading market share, broad geographic footprint, and diverse product offerings, enabling it to meet the needs of a wide range of homebuyers. The company has maintained a steady start pace to match demand, carefully balancing sales and inventory levels. D.R. Horton's strategy of selling a significant portion of its homes from completed specs has helped to generate consistent cash flow and mitigate the impact of interest rate volatility.

A key element of D.R. Horton's success is its capital-efficient lot portfolio. The company has strategically shifted towards a model that relies heavily on third-party developers. In Q2 2024, 62% of homes closed were built on lots developed by Forestar (NYSE: FOR), D.R. Horton's majority-owned lot development subsidiary, or other third parties. This approach allows the company to minimize its land ownership and investments in land development, freeing up capital for other priorities like share repurchases and dividend payments.

Looking ahead, D.R. Horton remains confident in its ability to generate strong cash flow from its homebuilding operations, projecting approximately $3 billion in operating cash flow for the full fiscal year. The company plans to utilize this cash to consolidate its market share further, continue growing its operations, and return capital to shareholders through share repurchases and dividends. The upbeat report has recently led D.R. Horton’s analyst community to upgrade the stock to a moderate buy.

Lennar: Embracing a Pure-Play Manufacturing Model

Lennar (NYSE: LEN) is another national homebuilding giant that reported consistent performance in its Q2 2024 earnings call. Lennar’s financial report detailed the challenges of interest rate volatility by strategically focusing on maintaining even-flow production and a disciplined approach to pricing and incentives. The company delivered 19,690 homes in the quarter, reflecting a 15% year-over-year increase, and achieved a gross margin of 22.6%, slightly higher than expected.

A central theme in Lennar's earnings call was the company's strategic shift towards a pure-play, asset-light manufacturing model. This strategy involves minimizing non-core assets, intensifying the focus on building affordable and attainable homes, and optimizing operational efficiency to reduce cycle times and construction costs. Lennar has also been aggressively pursuing a "land strategies" initiative to significantly reduce its land ownership and transition to a just-in-time homesite delivery system.

A key element of Lennar's land strategies is the creation of structured land partnerships with private equity investors. These partnerships allow Lennar to option-develop homesites on a rolling basis, reducing its land risk and freeing up capital for other uses. The company is also exploring a potential spin-off of a significant portion of its remaining land assets into a new public company, further accelerating its transition to an asset-light model.

Lennar's management expressed confidence in the company's ability to generate strong cash flow despite the challenges of the current market and highlighted its commitment to returning capital to shareholders. In Q2 2024, the company repurchased $603 million of its common stock and repaid over $550 million of senior debt, further strengthening its balance sheet. Lennar expects to continue its active share repurchase program throughout the remainder of the year.

Common Themes and Distinct Approaches for Homebuilders

The earnings calls of KB Home, D.R. Horton, and Lennar reveal several common themes and strategies employed by leading homebuilders to navigate the current housing market. All three companies are acutely aware of the risks posed by interest rate volatility and affordability concerns and are actively implementing strategies to address them.

A common theme is a strong focus on affordability. Each company is adjusting its product mix, pricing strategies, and incentive offerings to cater to a broader range of homebuyers, particularly entry-level and first-time buyer segments. All three companies have also demonstrated a commitment to managing interest rate volatility through a combination of mortgage concessions, price adjustments, and capital flexibility.

Another shared priority is capital efficiency. Each company is focused on optimizing its cash flow, strategically investing in land and development, reducing debt levels, and returning capital to shareholders through share repurchases and dividend payments.

While the three companies share common goals, their approaches and priorities exhibit distinct variations. Lennar, for instance, has taken the most aggressive steps toward a land-light model, significantly reducing its land ownership and embracing structured land partnerships with private equity investors. In contrast, D.R. Horton has maintained a more balanced approach to land ownership, relying heavily on its relationship with Forestar and other third-party developers for lot acquisition.

The companies also display varying levels of engagement in the rental housing market. Lennar has been actively developing single-family and multifamily rental properties, seeking to capitalize on the growing demand for rental housing. While also involved in the rental market, D.R. Horton has maintained a more moderate pace of investment in this sector.

Lastly, the companies exhibit differing levels of emphasis on technology investment and innovation. Lennar has been particularly active in this area, leveraging technology to enhance its sales and marketing capabilities, optimize pricing, and improve operational efficiency. While incorporating technology into their operations, KB Home and D.R. Horton have been less vocal about their technology initiatives.

A Complex Housing Market with Opportunities for Informed Investors

The earnings calls of KB Home, D.R. Horton, and Lennar provide valuable insights into the housing market's current state and the strategies leading homebuilders employ to navigate its challenges and opportunities. The housing market remains complex, with affordability concerns and interest rate volatility presenting ongoing headwinds. However, resilient demand, driven by favorable demographics and a persistent supply shortage, underpins the industry's long-term growth potential.

The three companies analyzed in this article have demonstrated their ability to adapt to the changing market dynamics, leveraging their scale, operational efficiency, and financial flexibility to maintain solid performance and capitalize on growth opportunities. While each company has adopted distinct approaches and priorities, their shared focus on affordability, capital efficiency, and managing interest rate volatility underscores the key considerations for success in the current market environment.

KB Home, D.R. Horton, and Lennar offer a compelling investment case with their strong financial performance, strategic initiatives, and experienced management teams for investors seeking exposure to the housing market. However, it is crucial for investors to carefully assess each company's risk profile, considering factors such as their geographic footprint, product mix, land strategies, and exposure to potential economic downturns.

Ultimately, the housing market's long-term prospects remain favorable, driven by the fundamental need for affordable housing and the ongoing supply shortage. As the market continues to evolve, informed investors who understand the industry's dynamics, the strategic initiatives of leading players, and the broader economic context will be best positioned to identify and capitalize on the opportunities that lie ahead.

Write this ticker symbol down… (Ad)

A megatrend now poised to mint a brand-new wave of millionaires right here in America.

And today, self-made millionaire Tim Bohen is giving you an inside look at the megatrend that's going to change everything.

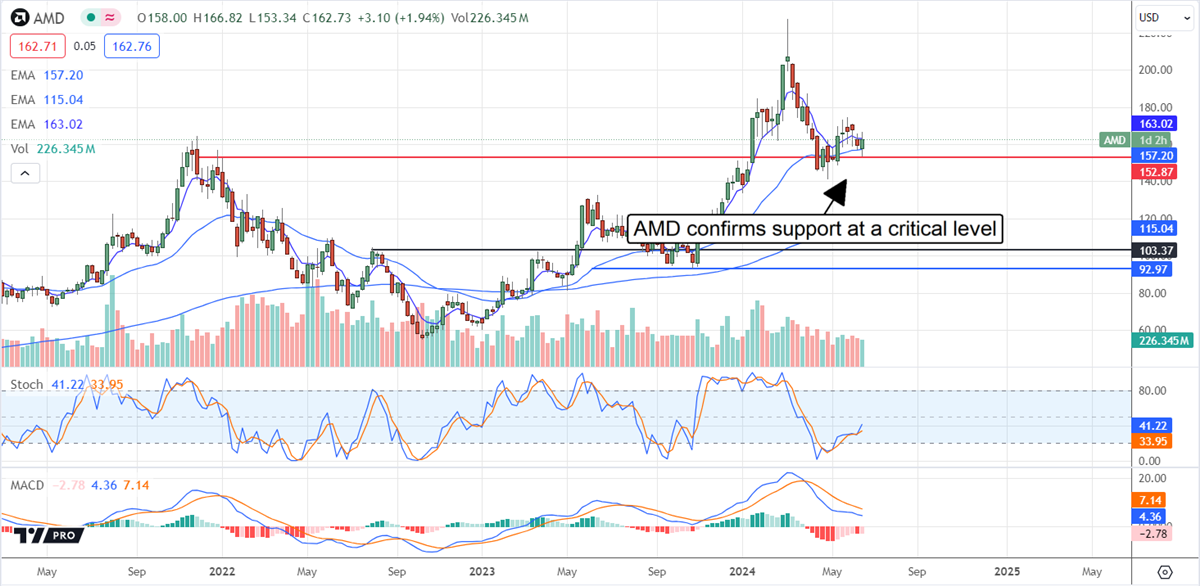

Is Advanced Micro Devices Stock Ready for Another Run?

Advanced Micro Devices (NASDAQ: AMD) stock is ready for another run higher; all you have to do is ask its investors. They’ll say yes. The question is whether the stock can make another run higher, and the answer is also yes. Late to the AI game, AMD AI accelerators are flooding the market and are boosting the business in Q2. It’s hard to say if AMD will gain market share from NVIDIA (NASDAQ: NVDA) or see a 200% increase in revenue the way NVIDIA did, but it will see substantial growth this quarter and over the coming years for more reasons than AI.

AI and data center accelerators are at the forefront of investors' minds, but legacy semiconductor businesses still exist. The legacy business struggled over the last two years due to over-supply, inventory reduction, and end-market normalization, but normalization is here. With the client and data center segments growing at an 80% clip, it will only take an end to a contraction in the gaming and embedded markets to drive significant top-line acceleration, and those legacy businesses will resume growth in 2025.

There is also the long-term outlook for AI to consider. Embedded and gaming segments are down today but will return to growth soon and participate in a secular grade upgrade cycle that could last more than a decade. AI begins with data centers, but It is moving to the edge of computing and into the IoT, which will drive business in the embedded segment for the next decade.

Analysts Favor AMD: Top Pick Among Large-Cap Chip Stocks

The analyst's activity is mixed in Q2, with numerous price target reductions offsetting price target increases and upgrades. The takeaway is that some analysts are trimming targets, but the group’s range is narrowing as consensus mounts, and they see this stock moving higher.

A significant number of analysts are covering the stock, so conviction is high, and activity is leading the market higher. The consensus sentiment is a firm Buy; the consensus target of thirty analysts is up 50% from last year and $5 in the last 30 days, suggesting a move to the high-end range is likely. A move to consensus puts the market for this stock near the all-time high; a move to the high range would set a new high.

The latest update comes from Piper Sandler, reiterating its Overweight rating and $175 price target. The firm chose AMD as its top pick among large-cap chip stocks for the 2nd half, citing the improving supply of MI-300 and a slate of new chips set to come out later this year, next year, and in 2026. Those include updated versions of the MI-300 and the 2nd and 3rd generation AI platforms, MI350 and MI400, which will compete with NVIDIA’s Blackwell and Ruben architecture.

Advanced Micro Devices Valuation No Concern With Growth Forecasted

Advanced Micro Devices trades at a relatively high 45x this year’s earnings outlook, but it is not a concern for investors. The growth outlook shaves the value considerably as soon as next year, bringing it into a more reasonable range near 27x. Because growth is expected to persist at a high level into 2026, the valuation falls further, putting this stock in deep-value territory. Assuming a 30x valuation for blue-chip tech leaders, this market could advance by $17 to a multi-month high on simple price-multiple expansion, and there is an upside risk. AMD will likely outperform the consensus estimate reported by MarketBeat and raise guidance, adding leverage to potential valuation gains.

The technical action is promising. The market for AMD stock broke to a new high early in 2024 and corrected to confirm support at the prior high. The market is now showing rising support at the critical level backed by the indicators. MACD is trailing stochastic; momentum has yet to resume bullish behavior, but stochastic is firing a solid entry signal within a market that is uptrending with room to run. In this environment, AMD shares could rebound to $175 soon and $200 by year-end, with a chance of hitting new all-time highs in 2025.

Government Loans (Ad)

There's a little known opportunity with government loans that are paying out fat double-digit returns.

My friend refers to these investments as "Tax Yields".

没有评论:

发表评论