Welcome! If this is your first time reading one of my postcards, catch up on my back issues here. And if you have questions or comments, shoot us a note anytime here or at feedback@rogueeconomics.com. | My Hunch About Commodities… and the "Era of the Lazy Dollar" By Tom Dyson, Editor, Postcards From the Fringe WEST PALM BEACH, FLORIDA – The Bloomberg Commodity Index tracks the prices of a basket of 23 commodities, including hydrocarbons, industrial metals, precious metals, and agricultural commodities. This is a chart of the Bloomberg Commodity Index expressed in terms of gold, going back to the 1960s.

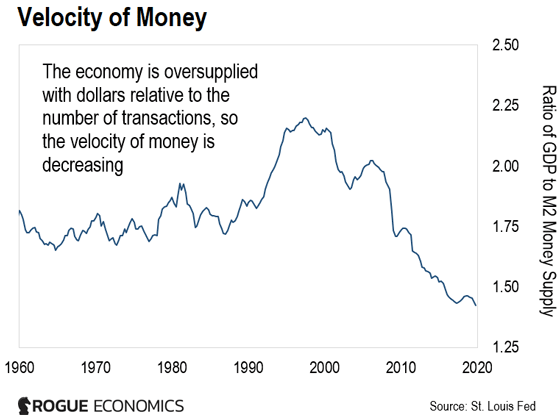

It shows commodities are very cheap today in terms of gold. This basket of commodities has fallen from 65 to 3.5 over the last 50 years. As far as I know, commodity prices are as cheap as they’ve ever been in terms of gold. That said, I’m not willing to trade any of my gold for zinc, gasoline, sugar, or cotton just yet. (My hunch is, commodities will keep falling in terms of gold for a few more years.) But there’s also a different chart that caught my attention. It’s got nothing to do with commodities. But it tells me we made the right choice going “all in” on gold two years ago… (More below.) Lockdown America Greetings from West Palm Beach, Florida… We’re making our final preparations to hit the road next week. I have a to-do list a mile long. But it’s fun and exciting getting ready for a trip like this. It feels like the last few days of boarding school before the summer holidays begin. I left the house yesterday for the first time in over a month to go to the supermarket. The roads were busy. The parking lot was full. The supermarket was busy. Are we really in lockdown? It didn’t seem like it. We’re taking our pop-up trailer to the mechanic to have the brakes and wheels checked before we leave. (Thank you to all of you who wrote in with advice on maintaining a trailer properly.) “How’s business?” I asked at the supermarket. “It was a little slow before,” he told me. “But we’re back to normal now.” | Recommended Link | "My Net Worth Went Up $10,000 Today!" —Lyle A. It's a fact. E.B. Tucker has helped folks make a lot of money over the years. And now he has a way for YOU to do even better (perhaps 100 times better)… Using an obscure (but super easy to trade) investment that 99.99% of Americans are completely unaware of. (Hint: It's not stocks, bonds, ETFs, options, futures, mutual funds, CDs, or private equity.) Think that sounds hard to believe? E.B. would likely agree… if he and his partners hadn't already used this secret investment themselves for the chance to bag extraordinary gains like: 218%, 220%, 277%, 350%, 420%, 433%, 650%, 1,054%, 2,450%, 3,922%, 5,509%, and 6,200%. $2,500 into each of those turns into over $567,000. That's life-changing. | | | -- | The Era of the Lazy Dollar This chart seems important, too. It shows the velocity of money…

It peaked in the year 2000, the same year as the Dow-to-Gold ratio peaked. And it’s been falling ever since. What message is it telling us? What is it about the economy that “changed” in 2000? Velocity of money is a measure of how fast dollars are flying around the economy. If velocity is sluggish, it means the economy is making each dollar work hard to satisfy all the transactions taking place throughout the economy. If velocity is low, the economy is not asking each dollar to do many transactions. Think of velocity as a measure of how “stretched” the money supply is relative to all the transactions taking place in the economy. If there’s too much money supply relative to total transactions, each individual dollar isn’t being asked to do that much work. Dollars can get away with being sort of “lazy.” Velocity falls. If there isn’t enough money supply relative to total transactions, each dollar has to fly around the economy and be involved in many transactions. It’s like the economy is calling each dollar to work harder. Velocity rises. Does this make sense? When I look at this chart, it confirms for me that the feds have created FAR TOO MUCH money supply over the last 20 years, relative to how many total transactions there have been in the economy. In other words, today’s economy asks its dollars to do a lot less work and spend more time being idle than it asked of its dollars in the year 2000. I’m honestly not sure if this chart will ever rise again. I think we’ve entered an era of history, where the feds will always make sure the economy is vastly oversupplied with dollars relative to the number of transactions taking place. We can call it the “era of the lazy dollar.” – Tom Dyson P.S. Thank you for all your kind and supportive messages, as always. And especially to those of you who invited us to come and camp on your properties! We would love to meet as many readers as we can on our trip around America... Like what you’re reading? Send your thoughts to feedback@rogueeconomics.com. FROM THE MAILBAG One reader asks Tom about writing the Postcards by hand… one asks about oil farms… while others share their loyalty to Tom and his investment advice… Reader comment: Thanks for taking the time to write your daily thoughts. I’ve enjoyed them and they’ve inspired me personally. Quick curiosity though; you mention, almost daily, that you’re writing by hand. Why is this? Why not just type your thoughts out instead of handwriting and transposing them later? Tom’s response: I’m not sure. I think it’s because when you write by hand, you don’t have the option of using the backspace key to edit yourself as you write, so the words flow out more readily. Writing does not come easy to me. So I have to use whatever “crutches” I can find to improve my productivity and my flow. Reader comment: I really enjoy your postcards, especially your trips. I’m 80 now, but when the kids were young my husband and I camped with a pop-up camper. Make sure that Kate knows how to hitch/unhitch the camper and how to drive it. Start on an interstate highway, and good luck learning to back into a parking space! Reader comment: I first started following you back when you wrote The 12% Letter in my early 20s. You were the person who cemented in my mind the value of compounding returns (I still hold some of your recommendations to this day!). When you left Stansberry, I was extremely disappointed but I was determined to follow you over to Palm Beach, where I also took your recommendation to invest in a Whole Life policy. I also continue to fund that to this day. When I noticed you weren’t contributing anymore, it left me wondering what happened. Then, a couple of weeks ago, by chance I clicked on a link regarding an interestingly named Postcards from the Fringe. Lo and behold, I see you as the author! At last, reunited!! I was distraught to hear about the difficult times you went through, but was so happy for how you came through it. I’m so sorry you had to go through what you did. Unfortunately, these things are sometimes out of our control, especially when it comes to psychological/emotional struggles. I just want you to know that I look up to you and that you really have made an impact in my life. Even though you are so accomplished and talented, and always gave such good recommendations and articulated your case with such simple clarity, you always did it while being so down-to-earth and sincere. Thank you for everything, and I look forward to continuing to follow you now that I have found you again! P.S. I’m glad you got your mojo back. I believe in you, you just have to believe in yourself! And one place I would recommend going to that's on the “fringe” is New Mexico. No one ever thinks about it. But it has lots of interesting places, both culturally and historically, and it’s an interesting place for kids, too. Especially homeschoolers (prehistoric cave dwellings and Native American/Spanish architecture and culture, dinosaurs, geological formations like Carlsbad Caverns, Jemez supervolcano, White Sands National Park, space attractions, etc.). Reader comment: I have been with Stansberry for 20 years and have followed you from The 12% Letter, to Palm Beach, to your world tour. It’s been quite an adventure and I am glad to have been along for the ride. Reader comment: I enjoy reading your posts very much, and look forward to the next road trip for the Dysons. Is there a specific company that specializes in building oil tank farms? It seems a quicker solution to the glut problem now prevalent in oil production, and I’m sure the Chinese are planning/doing the same since tanker building seems like such a specialized endeavour. Best of luck, Dysons! Tom’s response: I’m sure the Chinese are building more oil tank farms. Oil producers are essentially paying for it. Reader comment: Hi Tom, Kate, and family. I have been enjoying your postcards from the beginning and also reading some of what you wrote in previous years. Your personal story of struggle and victory from the last few years has been an encouragement to me. Hope your travels are great, regardless of where you go! Enjoy your pop-up camper. We have enjoyed many happy times camping in a pop up. Reader comment: We enjoy reading your Postcards and the reassurance you give us for our decision to invest in gold bullion some months ago. I noted your concern about what reception you get when you travel around America. Tell them you are a journalist gathering data from the trenches as to what is really happening for the mass of Americans. All true, and I’m sure you will get plenty of people wanting to share their stories. All good data for your next book. Enjoy your trip. Tom’s response: As always, thank you for your kind notes and messages! Please keep writing us at feedback@rogueeconomics.com. IN CASE YOU MISSED IT… Imminent FDA Approval Could Send This Tiny Biotech Soaring As the ultimate gatekeeper in the drug approval process, the FDA has the power to drive share prices through the roof. Here are just a few recent examples we've identified: - Agios Pharmaceuticals: +740%

- MyoKardia: +884%

- G1 Therapeutics: +442%

- Regenxbio: +894%

- Clovis Oncology: +585%

- Karuna Therapeutics: +629%

- Amarin: +733%

- Agile Therapeutics: +1,086%

Right now this tiny biotech stock is next in line for FDA approval. The big announcement is due in the third quarter – possibly as soon as July 1st. So there are literally days left to act. Click here before it's too late.

|

没有评论:

发表评论