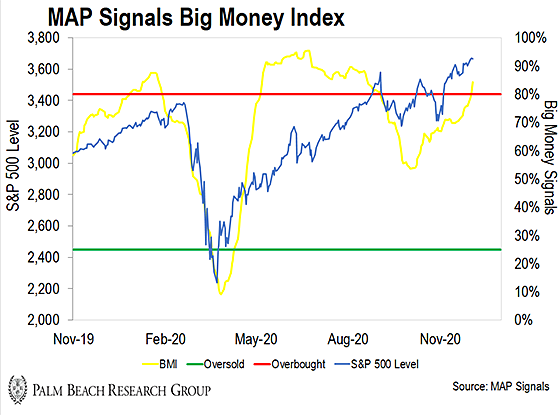

| Welcome! In this free e-letter, I’ll show you where the big money is headed in the markets so you can follow it to profits. And we love to hear from our subscribers… Tell us what you like, what you hate, and how we can make Palm Beach Insider the best free e-letter on following Wall Street to profits right here. | The Market’s Overbought Again… But Don’t Sell These Specific Stocks By Jason Bodner, editor, Palm Beach Insider Growing up, I remember watching a ton of Clint Eastwood movies. A favorite was The Outlaw Josie Wales. I can still see Josie riding up to a deserted town; the tumbleweeds rolling past the saloon. He took stock of the situation. He’d have his ear to the ground. Back then, like now, being alert was critical. In order to hear the far-off hoofbeats of a cattle herd, or an incoming posse, cowboys borrowed a Native American method of reconnaissance. No one could pull a fast one on Josie: he’d always have an awareness about him. Markets, like Josie, have no room for surprises. Every now and then we enter new territory, where we have to adapt our trading plan for the unexpected. And yesterday morning, my proprietary Big Money Buy/Sell Index (BMI) reached territory we haven’t seen in months: overbought. This is important. It’s our initial signal to be on the lookout for frothy (greedy) market conditions. And in today’s essay, I’ll share my trading plan for when big-money buying gets a little out of hand… Levels Not Seen Since May If you’re new to Palm Beach Insider, you may not be familiar with the BMI. But it’s simple to understand… The BMI measures the magnitude of big money buying (or selling) in the market at any given time – using a 25-day average of big-money activity. I’ve boiled it down to a simple yellow line and two thresholds. When the yellow line crosses the upper red threshold, markets are getting overheated and it’s time to start looking for places to take profits. When it crosses the lower green threshold, the market’s getting oversold and it’s time to look for buying opportunities. Anywhere between those two levels is neutral ground – with the line’s direction signaling the big money’s risk appetite. Undefeated in 2020: Every crypto he’s recommended has exploded in price. The BMI has been especially accurate this year. For example, the BMI prefaced the big March selloff, and foreshadowed the subsequent huge rise. Then it alerted us to the pre-election selling, as it started to dip from overbought levels in September. Then it made a hairpin turn right before the election and started to rise. And now, you can see it pierced overbought levels in the most recent reading…

But that doesn’t mean you should go and sell all your stocks. In fact, I expect the BMI to rise even more for some time… Just look at how the BMI acted in summer of this year. It spent nearly four months in overbought territory after first piercing the upper threshold. So, it’s possible that the market could keep running higher. But there are some specific shifts in activity to look out for… Just like in September, a falling BMI is one of the critical shifts I look for. When the BMI begins falling when overbought and eventually falls out of overbought territory, that tends to signal broad market selling is on its way. But as useful as the BMI is, it doesn’t tell the whole story for each sector of the market. In fact, there are some surprising sectors that aren’t quite overbought right now… A Surprisingly Unloved Sector Three weeks ago, I discussed the “value rotation” in stocks after the initial vaccine news hit the airwaves. While all the most hated sectors of the year rallied (energy, industrials, airlines, and “reopening” stocks), some of the hottest sectors pulled back (namely technology). “Reopening” stocks are the ones that COVID-19 brought to their knees. Think about all the travel companies, movie theaters, brick-and-mortar retail stores, and restaurants that had to shut their doors… But now, many reopen sectors are approaching extreme levels of buying. Naturally, the idea of widespread COVID vaccination is boosting investor confidence and lifting these stocks to new recent highs. My data tells me that this “reopening” trade is a bit extended. Across the materials, industrials, financials, real estate, and energy sectors, I’m seeing a huge boost in buying momentum. In some cases, more than at any other time this year. But some of the best performers in the stock market this year – technology and healthcare – are subdued. So, what does this tell us? Even though these prior beaten-down sectors, making little in revenue and earnings, are at frothy levels… Technology and healthcare with great fundamentals (which kept the market afloat during COVID-19) are not. Ear to the Ground My trading plan in this new overbought territory is simple – keep buying the businesses that will do well, pandemic or not. Right now, those are cutting-edge technology companies. Even though the first signs of froth have arrived, there is likely more room for stocks to rise. As we cross into this new territory, we must keep our ear to the ground for excessive greed. That will be our signal that a selling stampede is near. It’s like the setup of an old Western movie… Everything seems fine until danger strikes. For now, I don’t suggest fighting the trend. But don’t be caught off guard. Position yourself in the year’s biggest market winners at these discounted levels. When the “reopening” trade finally loses steam, you’ll be glad you did. Patience and process! Jason Bodner

Editor, Palm Beach Insider

Like what you’re reading? Send us your thoughts by clicking here. IN CASE YOU MISSED IT… THIS DEMANDS YOUR FULL ATTENTION The FDA has triggered a rare moneymaking situation in the biotech market. It almost never takes place… and we may never see it again in our lifetimes… but according to millionaire angel investor Jeff Brown, it demands your undivided attention. Because when it strikes, it can ignite the fastest and largest gains in stock market history. It’s literally possible to see up to 1,000% gains in one day. And that’s just the start. You can get the details during Jeff’s biotech masterclass. It’s 100% free. RSVP NOW.

Get Instant Access Click to read these free reports and automatically sign up for daily research. |

没有评论:

发表评论