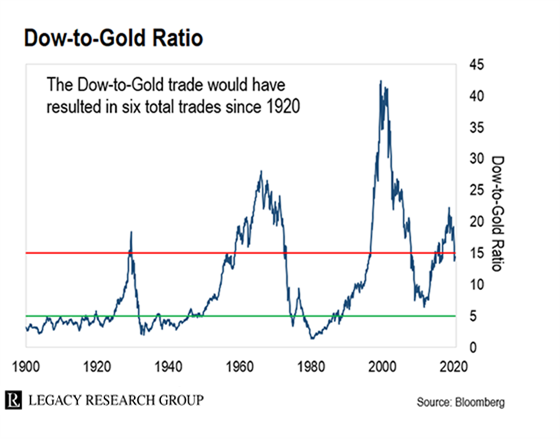

| By Tom Dyson, Editor, Postcards From the Fringe The most important trend in finance is the decline in the Dow-to-Gold ratio. The Dow-to-Gold ratio tracks the 30 Dow Jones stocks as priced in gold. It tells us the best time to buy gold, and the best time to buy stocks. It peaked in 1999 at 41. Then, it began what I call its “long walk down the mountain” to where it always ends up. That is, below 5. Let’s call this the “primary trend.” But along this primary trend, it got waylaid. It spent eight years backtracking. Eight long years… of fake money and rising stocks. Now, finally, this most important trend in finance is “back on.” To my mind – and for my money – it’s presenting the biggest opportunity to profit since, well… I found bitcoin in 2011. It’s go time. This is it. | Recommended Link | | Discover the World's First Unbeatable Stock-Picking System

What would you say if you heard there was a breakthrough stock-picking system that could have helped you make 968 trades that paid 10-to-1 or more on your money…? What would you say if that same system would have helped you identify the #1 stock on the S&P 500 almost every year for the past three decades (including the past six years in a row)…? What would you say if that system could have turned $1,000 into more than $19.7 million…? Skeptical? | | | -- | My Gold Story: Why I Went "All In" I left my job nearly two years ago. We sold all our things. Kate (my ex-wife) and I hit the road with our three kids. We don’t have anywhere to live. And we homeschool the kids. We left “the matrix” in another important way, too. When we left America, we drained our bank accounts and retirement accounts of cash, and we converted all our savings into gold and silver. Why did we do this? We don’t want to be in the system anymore. It’s unbalanced and unstable. So we’re going to sit on the sidelines, in precious metals, until it’s safe to return to the financial system. When it’s finally safe, we’ll sell all our gold and invest in the top dividend-raising stocks. Our money will stay there – I hope – generating bigger and bigger dividends for the rest of our lives. (More on this in a moment.) How will we know when it’s safe? That’s where the Dow-to-Gold ratio comes in. It’s the ultimate barometer of systemic “health”… Recent Reversal Our Dow-to-Gold trade is based on a simple premise… You buy stocks when they’re cheap relative to gold. That is, when the Dow-to-Gold ratio is below 5. Why Are Cannabis Stocks Suddenly Soaring? Then you sell stocks when they become expensive – when the Dow-to-Gold ratio rises above 15. At that point, you return to gold. Over the course of the last 100 years, you would have made only six trades. But you would have also handily beaten a “buy-and-hold” approach. The chart below shows it all. The towering peak in 1999. The countertrend rally from 2011 to 2018. And if you look carefully, a recent reversal…

I interpret this recent reversal as the Dow-to-Gold’s primary trend reasserting itself, getting back on track, and once again marching back down towards single digits. This next chart shows the zoom-in on the last two decades or so…

The ratio topped out at 22.36 in October 2018. It’s been falling since… and I speculate it’s about to head much lower. Of course, if I’m wrong, and the Dow-to-Gold ratio isn’t ready to resume its primary trend lower, the market will let us know. How? By making a new high, rising above 22.36, and invalidating the downtrend. (It’s why I set our “stop-loss” at 22.36.) But I’m willing to bet that’s not going to happen… | Recommended Link | COVID Surprise: Nobody Saw This Coming!

The man some call America's #1 tech expert, Jeff Brown, has just released this shocking pandemic update. It has nothing to do with a vaccine. Instead, Jeff is saying the pandemic has triggered what he considers to be the most profitable event in the stock market history… Something he calls ALDL. Hurry… The World Economic Forum says "the train is leaving the station, and individuals need to get on board quickly." | | | | Trend in Motion The ratio likes to move in big, clear trends. And once it’s in motion, it tends to stay in motion. Its drop in 2018 implied to me that gold would start outperforming the stock market… possibly for as much as the next 5 or 10 years. I immediately drained my bank and retirement accounts and put everything into gold and silver. Then, I started nagging my friends and family to do the same. Remember, the ratio peaked in October 2018 at 22.36. My hypothesis is that the Dow-to-Gold ratio is now back on its way down… to a level somewhere below 5. Legacy cofounder Bill Bonner calls this its “rendezvous with destiny.” I’ll hold my gold until then, at which point I’ll sell it all and invest the proceeds into the stock market. In the meantime, I’m keeping an eye on the Dow-to-Gold ratio. Regards, Tom Dyson

Editor, Postcards From the Fringe Chris’ note: At writing, the Dow-to-Gold ratio is 15.98. So Tom is still waiting to trade in all his gold for stocks. Tom tracks gold’s moves… and shares his family’s travel adventures… in his daily e-letter, Postcards From the Fringe. Keep up by subscribing for free here. Like what you’re reading? Send your thoughts to feedback@legacyresearch.com. IN CASE YOU MISSED IT… Why bother? Do you see this pile of cash? That's how much it would cost you to buy one share each of Apple, Amazon, Google, and Tesla. Why bother? When you could profit off the growth of those same companies – and the tech bull market overall… For just $3. Click here for the full story.

Get Instant Access Click to read these free reports and automatically sign up for daily research. |

没有评论:

发表评论