Will the S&P find bullish legs or nosedive?… the indicator our technical experts are watching that appears bullish… how things played out the last three times this indicator triggered Will the S&P hold support?

That’s the most pressing question facing investors at this moment.

Some quick context to make sure we’re all on the same page…

After falling hard all year, the S&P staged a furious rally beginning in mid-June that saw the index gain 17% over about a month.

To many bulls, it was evidence that the bear market was over. To many bears, it was just a bear-market rally.

Since mid-August, the S&P has now fallen back to its mid-June low. This suggests it was a bear-market rally.

But…

What if it’s something that technical traders call a “double bottom”?

In other words, what if the June rally was just the market’s first attempt at bullishness? That attempt fizzled, but that doesn’t mean a complete failure.

Instead, what if the S&P is now “double-bottoming,” or re-testing its June-low? And if it passes this test, that’s when the rally will resume, only this time with greater strength.

That’s the bullish hope.

In the chart below, we show why this “make-or-break” level is such a big deal.

We highlight the support level at which the S&P finds itself today, and we add a trendline showing the progression of “lower lows” for the S&P on the year that we’ve extrapolated.

Here’s the takeaway…

If support holds, wonderful. All eyes will be on how quickly we can race back toward the 4,300 level to re-test August’s resistance.

But if the S&P can’t hold support, then the “lower lows” trendline suggests we’re on our way toward the 3,300 area.

Clearly, this is an important moment for the markets and your portfolio in the near term.

So, back to our opening question…

Will the S&P hold support?

According to our technical experts John Jagerson and Wade Hansen of Strategic Trader, we have an excellent chance: One of our favorite sentiment indicators is telling us traders have likely hit their point of maximum pessimism. This is a strong contrarian signal that the bulls may start to recover some short-term momentum. Today, let’s look into John and Wade’s latest update to see why we shouldn’t count-out a bullish bounce. ADVERTISEMENT Inflation-Proof? Instant Cash Payouts in ANY Market THIS Is the #1 Way to Beat Inflation. If you’re worried about inflation…And the up-and-down markets, you’re not alone. But… if you’re willing to learn something new…You can generate steady, instant cash payouts of as much as $700… $1,375… or even $2,290… No matter what the market does next. Get the free details here. How to turn the “fear gauge” into a crystal ball For newer readers, John and Wade are the analysts behind Strategic Trader, InvestorPlace’s premier trading service. John and Wade combine options, insightful technical and fundamental analysis, and market history to trade the markets in all sorts of conditions.

Since mid-August, those conditions have been sharply lower. But there’s one indicator John and Wade are watching that leads them to believe this could be changing.

It involves the CBOE S&P 500 Volatility Index, known as the VIX. Many investors are familiar with this. It’s a measurement of the anticipated volatility being priced into S&P 500 options for the next 30 days. An elevated VIX reading suggests greater anxiety amongst traders.

But John and Wade note that sometimes focusing only on the next 30 days isn’t a long enough view. It can be helpful to expand your horizons to the next three months, or 90 days.

For such a longer-term outlook, traders look at the CBOE S&P 500 3-Month Volatility Index (VIX3M). It’s a measurement of the anticipated volatility being priced into S&P 500 options for next 90 days.

And by comparing the VIX with the VIX3M, investors can get even more information.

Here’s John and Wade: Because these volatility indexes measure the magnitude of the price movement traders believe the S&P 500 may make during the measured time frame, the value of the VIX3M is usually higher than the value of the VIX.

After all, if you give the market three months to make a move – like the VIX3M measures – instead of just one month – like the VIX measures – it has a greater chance of making a larger move.

Interestingly, there are times when traders will price in a greater chance of a larger move in the short term than in the long term because they are nervous the market is about to drop. This pushes the value of the VIX up higher than the value of the VIX3M. The easiest way to compare the VIX and VIX3M values is to create a relative-strength chart of the indexes Specifically, you divide the value of the VIX by the value of the VIX3M.

In normal conditions, this comparison chart will have a value of less than 1. That’s because the value of the VIX is usually less than the value of the VIX3M.

But when traders are anxious about an immediate market drop, the value will rise above 1. This shows higher anxiety for the next 30 days compared to 90 days.

So, where are we today?

Here’s John and Wade with those details: Right now, the VIX/VIX3M chart has been >1 for the past three days (see Fig. 2) [written on Wednesday].

Fig. 2 – Daily Chart of the VIX vs. VIX3M Comparison Chart (VIX/VIX3M)

ADVERTISEMENT “These 10 Stocks are set to THRIVE – No Matter What Comes Next.” The same system that predicted the current bear market just made a shocking new forecast about what’s coming next – including ten free opportunities that could make you profits even if inflation gets even worse. Click here to watch now. This tells us that traders have pushed the market toward maximum pessimism and are likely to stop and take a deep breath.

As you can see in Fig. 2, traders have pushed the VIX/VIX3M above 1 four times during the past year.

So, what has happened to the S&P 500 when the VIX/VIX3M has risen above 1?

As you can see in Fig. 3, support was established on the S&P 500 each time the VIX/VIX3M rose above 1.  Fig. 3 – Daily Chart of the S&P 500 (SPX) Fig. 3 – Daily Chart of the S&P 500 (SPX)

Let’s dive into the details of these prior “VIX/VIX3M > 1” moments Matching the red numerical points in the chart above to how things played out in the market, here’s what John and Wade found:

Point 1 – the S&P 500 established support at 4,500 and bounced higher.

Point 2 – the S&P 500 established support just below 4,200 and bounced higher.

Point 3 – the S&P 500 established support just below 4,200 and started to bounce higher. However, the Fed killed this support bounce when it raised interest rates by 0.50% on May 4 (the first time it had raised interest rates by more than 0.25% since 2000).

And that brings us to today at Point 4. The level to watch right now is 3,650. As I write Friday morning, the S&P sits at 3,654.

Keep in mind, 3,650 is not an ironclad “you shall not pass!” line.

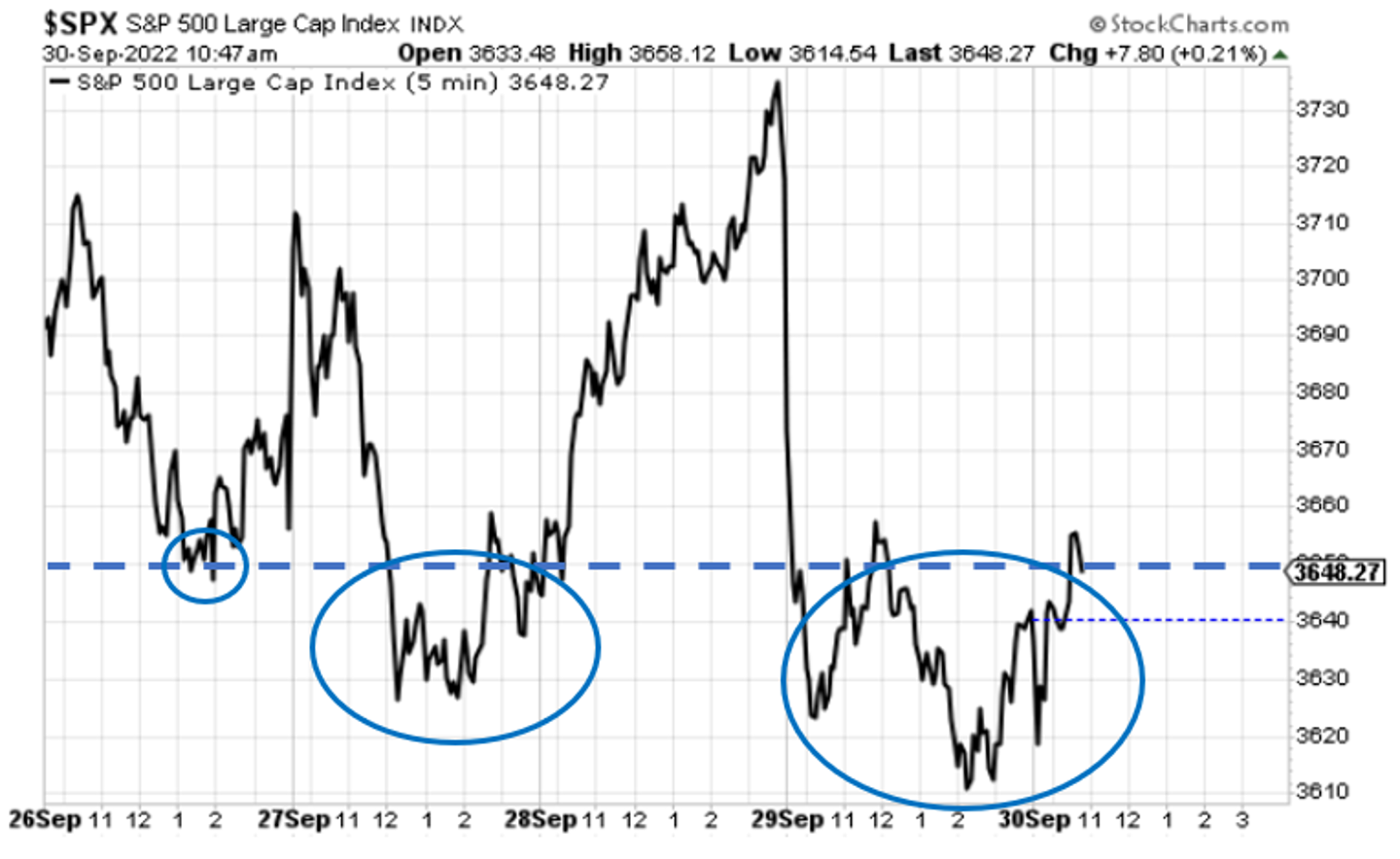

For example, the S&P has already dipped below 3,650 on a handful of occasions this week, as you can see in the S&P’s 5-minute chart beginning Monday.

So, as long as the S&P remains in this general area, we’re still “holding support.” ADVERTISEMENT The $7 Retirement Secret--Revealed Here Retired or about to retire? Need A LOT more income? No problem…Former fund manager shows you how one simple transaction can get you instant cash payouts of as much as $1,290… $1,525… and $1,795 IN A SINGLE DAY. If you’re “behind” on retirement, this could be perfect for you. Free details here. Putting all of this together, here’s John and Wade’s final takeaway: Will the index bounce higher from this support level?

We think it has a good chance of moving back up toward 3,800. Wall Street is already expecting the Fed to continue being aggressive with its rate hikes so there shouldn’t be any big monetary policy surprises.

As long as we don’t get any terrible economic surprises, traders may finally start to buy the dip. We’ll keep you updated here in the Digest.

Have a good evening,

Jeff Remsburg |

没有评论:

发表评论