| Tesla CEO, Elon Musk, shocked investors when he told them that lithium refining is a "license to print money" a little less than a year ago. Lithium is a key component used in making electric vehicle batteries. The demand for lithium has shot up significantly over the years and will continue to play a critical role in the development and widespread adoption of EVs. Goat Industries (OTC: BGTTF) is well aware…and they've been actively pursuing mining claims to get in on the action…even though the company has absolutely NOTHING to do with the space right now. That hasn't stopped the stock from taking a wild ride. Shares spiked by more than 400% from their January lows before crashing back down to Earth. But that hasn't stopped one promoter from trying to get the excitement back into the name. Will it work? I share my thoughts below… Goat Industries Ltd. (OTC: BGTTF) - 1-month trading range: $0.0071 - $0.0187

- Typical average daily volume: ~61,530

- Float: 326.16 million shares

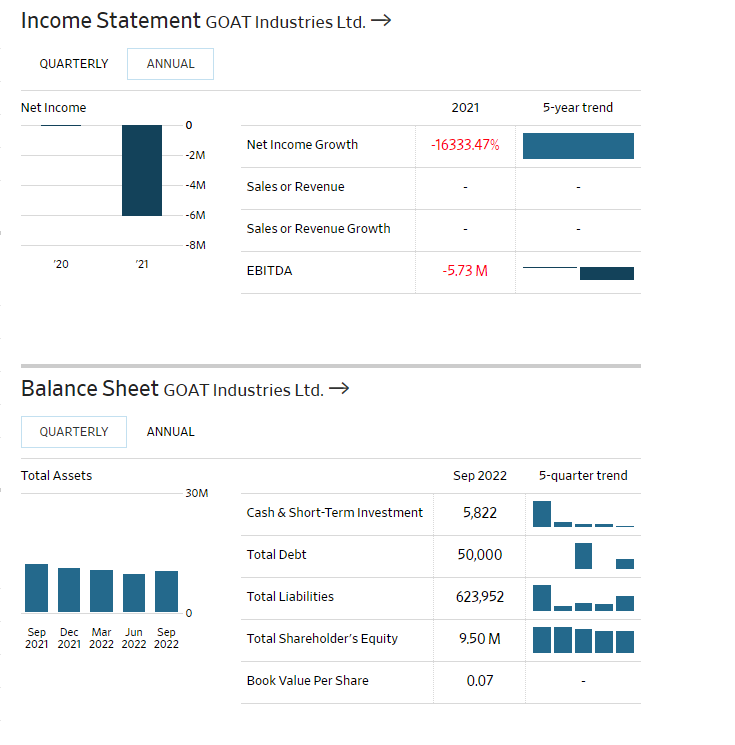

Goat Industries Ltd. Goat Industries is an investment holding firm. It invests in and provides strategic assistance and network connections and supports its portfolio companies. Its current portfolio includes Sophie's Kitchen, a plant-based seafood company whose frozen products can be found at amazon.com, Wal-Mart, Wegmens, and Stop & Shop. It is set to acquire a 46% equity interest in the brand. Goat also owns 100% of Kojo Pet Performance, a producer of all-natural pet food. Evanesce is another brand under the Goat portfolio. The company focuses on making compostable packaging material. Goat has a minority stake in the company. What do these have to do with lithium? Absolutely nothing. For whatever reason, Goat has decided to scoop up mining claims it can flip to companies for a profit. Goat also has mining claims across Canada. And has been actively pursuing new deals. Goat believes it fits with its strategy of investing in resources that drive the growth of the electronics and battery metal industries. Financials You won't be impressed with Goat's financials if you're a value investor. The company's return on assets, equity, and return on total capital are all negative, at -106.5%, -108.8%, and -102.5%, respectively. However, it seems to have plenty of liquidity, with a current ratio of 16.9x. But it's hemorrhaging money. The firm's free cash flow is negative $443,310.

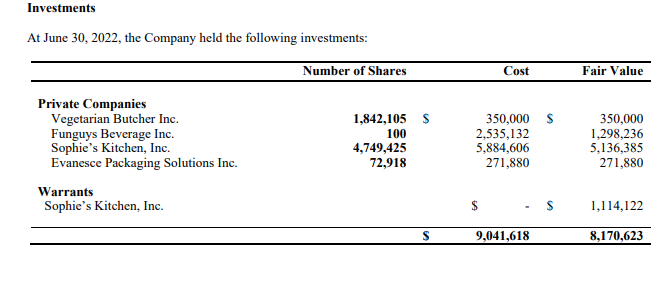

Source: WSJ As of June 30,2022, it had the following assets:

(Priced in CAD) The company has been issuing shares like crazy…going from 67.5 million in June 2021 to 104.0 million in June 2022. Given the current performance and the typical holding period for mining claims, I suspect they'll need to raise even more cash to pursue their new endeavors. Promoter Activity As far as I know, the promoter activity comes from just one source via email. It highlights the company's latest activity in the mining space. - On March 23, it took stakes in four mining claims in close proximity to Brunswick Exploration's PLEX Project in Quebec.

- On March 24, the company announced mining claims in Quebec.

- And on March 29, it announced mining claims adjacent to Patriot Battery Metals and Li-FT Power in James Bay, Quebec.

Goat has been active in the mining space since October of 2022, when it announced it was acquiring the Canadian lithium solvent extraction technology license. The deal gave Goat a license to use lithium solvent extraction technology in Canada from Ekosolve Ltd. They highlight these investments and paint BGTFF as a lithium play, a key element in making electric vehicles. The promotor then highlights the recent price action in BGTFF, which for traders, is a key selling point. The stock has surged from a low of $0.0037 in January to a high of $0.02 in March—a gain of more than 440%. It's fair to say the promoter did a decent job here. Now, they had initially been contracted from 9/17/2021 to 10/12/2021 for $45,000. Their second agreement went from 10/13/2021 to 12/15/2021 for another $45,000. Then we found something interesting. The promoter ran a campaign from 4/6/2022 to 4/12/2022, which they claim they were not paid. That's not common at all. Their next campaign was on 11/29/2022 for $5,500. This latest one-day campaign ran on 3/30/2023, for which they got another $15,000. Straight to the Fact Tesla's latest resurgence has many traders interested in EVs again. And BGTFF could be in play with the right catalyst. Shares saw above-average volume, trading nearly 900K shares on 3/30. While that's still light, it's clear the promoter's having an impact. And given the history, Goat is likely to pay for additional promotions in the near future. Always at your service, Baron Von Stocks |

没有评论:

发表评论