The stock market is breaking down. The intermediate- and longer-term trends are in the process of shifting from bullish to bearish. And, as we’ve pointed out several times over the past few weeks, this action is going to be painful for most traders over the next several months. Over the next several days, though, it looks like the pain trade is to the upside. Let me explain… | Recommended Link | Trader Legend Reveals “3-Stock Retirement Blueprint” Jeff Clark, the self-made multimillionaire, has helped people from all walks of life retire wealthy for the past 36 years...

His plan is designed to get your retirement on the fast track with his unique strategy.

What’s more... it’s a piece of cake.

“With my strategy, you can take advantage of it with as little as a few minutes a day.”

—Jeff Clark

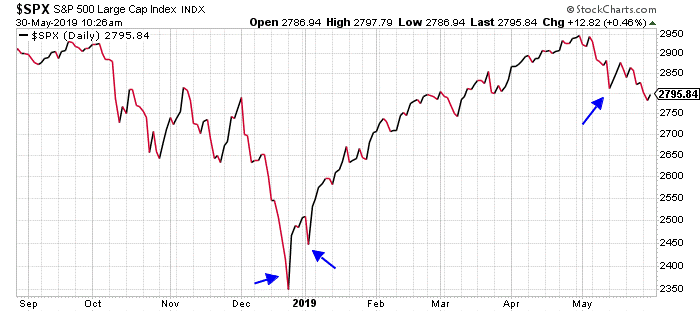

Do you know what it really takes to become a successful trader? | | | — | Everybody in the world was buying put options on Wednesday. Okay… that’s an exaggeration. Not everybody in the world was buying puts. But, enough traders were doing so that the CBOE Put/Call ratio (CPC) reached its second highest reading of the past year. Regular readers know the CPC is a short-term, contrary indicator. It compares the action in call options to the action in put options. A reading above 1.20 shows extreme bearishness among speculators and can indicate a good time to buy stocks for the short term. A reading below 0.80 shows extreme bullishness and could indicate a good time to sell. On Wednesday, this signal said BUY. Take a look…

The blue arrows on the chart point to recent times when traders were aggressively buying more puts than calls. Here’s how the S&P 500 looked on the three previous times…

Each occurrence marked at least a short-term bottom in the broad stock market. On Wednesday, the CPC closed at 1.41 – which indicates an extreme level of pessimism among traders. The only time in the past year when traders were more bearish was on Christmas Eve. In hindsight, of course, it was far more profitable to be a buyer of stocks on Christmas Eve than a seller.

I suspect a couple of weeks from now, we’ll look back on Wednesday’s high CPC reading and say the same thing. This doesn’t at all change my longer-term perspective of the stock market. Stocks will likely be lower at the end of the year than where they are today. But, over the next two weeks, stocks will probably be higher. Best regards and good trading,

Jeff Clark P.S. Just a quick reminder… Today is the last day you’ll be able to get early-bird tickets to the second annual Legacy Investment Summit. It’s from September 23-25 in Southern California. And I want to invite you as my guest. Getting tickets today means paying hundreds of dollars less than anyone who waits. And, I won’t be the only one there… Other investment greats like Teeka Tiwari, Jeff Brown, and Doug Casey will be there, too. If you’d like to spend a few days at a beautiful hotel with great food, drinks, and some of the biggest names in the investment world, read on here and grab your early-bird tickets. Reader Mailbag Today, one subscriber comments on Jeff’s Memorial Day piece, “Freedom Never Goes on Sale”… Your Memorial Day column is a well-written salute to those who have given their lives through their service and support for Americans' freedom. The crosses on the hillside are a visual epitaph for those described within your column, and your reminder freedom never goes on sale. For these reasons, your column evoked an emotional state in which I was both saddened and strengthened. As a Memorial Day reminder, thank you for doing so. – Bill And another subscriber gives Jeff a quick “thank you”… Thank you, Mr. Clark. I look forward to making money over the next year and learning as much as I can from you. – Bradley Do you think the stock market is headed higher or lower? And how are you trading, based on that? Let us know what you’re currently trading, along with any other trading questions, suggestions, or stories at feedback@jeffclarktrader.com. |

没有评论:

发表评论