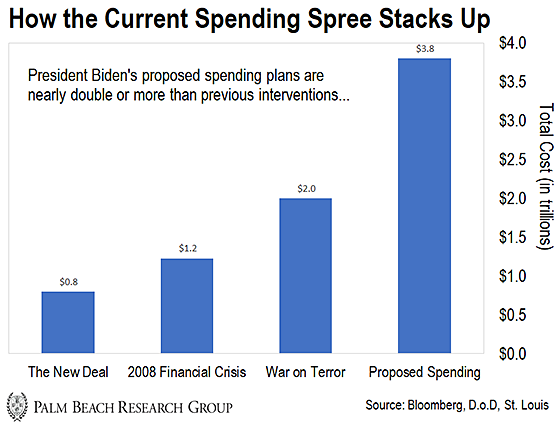

| By William Mikula, analyst, Palm Beach Daily On Wednesday night, President Joe Biden laid out the details of his American Families Plan… It’s a $1.8 trillion proposal that includes everything from childcare spending… to free community college… to paid family leave. President Biden also intensified his push for bipartisan support of the $2 trillion infrastructure plan he announced last month… the outcome of which is still uncertain. But whether you view these plans as a spending boondoggle or a boon to the economy… we see it as an opportunity to make triple-digit gains from some of the biggest names on the market: Blue-chip stocks. It’s all due to what we call an “Anomaly Window.” An Anomaly Window is when an event or catalyst massively increases activity in the market for a certain period of time. And when these windows open, they can send ordinary, boring blue-chip stocks to crypto-like gains. Thanks to the government’s response to the COVID-19 pandemic, we’re in the midst of the largest Anomaly Window in history. For a clearer picture of just how significant this window is, check out the chart below. It shows the size of Biden’s recent proposals compared to prior government interventions:

As you can see, the government is preparing to send a tsunami of cash into the economy. The thing is, a huge chunk of this cash always manages to find its way into the market. For instance, a recent survey from Deutsche Bank found half of respondents aged 25–34 planned to invest 50% of their most recent stimulus checks… And they plan to invest as much as 37% of future stimulus offerings. So in today’s issue, I’ll show you a strategy you can use to potentially rip triple-digit gains from Biden’s spending bonanza… | Recommended Link | 10X Bigger Than Amazon, Apple, and Google?? Jeff Bezos, Elon Musk, and Mark Zuckerberg... Along with the Army, Navy, Marine Corps, Air Force, and Pentagon... Are all piling into a controversial new technology. According to the World Economic Forum, this new technology could be worth $12.7 trillion over the next few years… That’s 10X the size of Amazon today. And bigger than mega tech firms like Amazon, Apple, Google, and Facebook combined. If you’re looking to cash in on the next major tech trend… This is it. | | | | Crypto-Like Gains From Boring Blue Chips We call this strategy our “Instant Cash Payout” method. In technical terms, it’s selling put options. Now, when people see “options,” they think of risky trades and huge losses. But our Instant Cash Payout method is relatively low risk… And when done right, it’s incredibly easy. Using a unique aspect of the options market, we agree to buy investors’ shares for a specific price… and a certain length of time… in exchange for an upfront cash payout. The cash (called the “premium”) is ours to keep… no matter what happens with the underlying stock. And we only have to buy shares in the company (which we like, anyway) if they drop to our agreed-upon price. The bottom line: We get paid to make an offer on companies we love – at a discount. That’s why we call it an Instant Cash Payout. It’s like being paid to agree you’ll buy your favorite piece of real estate if it drops to a lower target price. It’s a no-brainer. Emergency Briefing: “The Great Reset” Since 2012, we’ve made 377 trades just like this. And 369 of them have closed for a profit. That’s a 98%-win rate – and that’s virtually unheard of in the investing world. And here’s the thing… This strategy is especially powerful during Anomaly Windows. The last time an Anomaly Window opened was during the 2020 U.S. presidential election. The uncertainty surrounding the outcome created volatility in the market. From October 23 to November 2, the S&P 500 fell 5% − a considerable drop in such a short period. And while most investors fretted, we took this as our signal to strike… We sold options on some of our favorite blue-chips across a handful of trade alerts. And the returns were incredible: 612% in 42 days on Jefferies Group -

704.5% in three months on Target -

128.6% in four months on eBay -

92.3% in 28 days on Pfizer That’s enough to turn a starting stake of $10,000 each into an average of $141,626. Let’s put that in perspective… To amass that kind of windfall using the S&P 500’s average annual return of 10% would’ve taken about 13 years… But we did it in an average of 72 days. Now, with the largest Anomaly Window in history wide open, we expect to do even better. Here’s where I’m looking for trades… | Recommended Link | | Emergency Briefing: “The Great Reset” By May 28, Americans could be faced with a difficult choice: Accept a “Great Reset” and risk losing the American way of life… or stand up and fight back to save what’s left of the American dream. Jeff Brown, member of a D.C.-based advocacy group, explains what every American must do before May 28 to preserve his assets and thrive. | | | -- | Now’s the Time to Strike Infrastructure is at the front and center of President Biden’s current agenda… And combined with his American Families Plan, that’s almost $4 trillion in additional government spending. A great deal of that capital will inevitably find its way into blue-chip companies poised to help improve infrastructure and quality of life for millions of Americans. In particular, I like stocks in the domestic semiconductor space… specialty steel… and 5G buildout plays. These sectors are poised to do well as the economy continues to reopen. The additional infrastructure stimulus is just icing on the cake. If you’ve never sold a put option before, once you find a stock you like, reach out to your broker and tell them you’d like to know more about “selling cash-secured put options.” It’ll be your first steps toward getting your account ready to go… and getting paid to buy your favorite stocks at a discount. Teeka Issues FREE NEW Recommendation (No Purchase Necessary) Alternatively, you could look at the exchange-traded funds (ETFs) for the sectors I just mentioned. Three of the biggest are the iShares PHLX Semiconductor ETF (SOXX), VanEck Vectors Steel ETF (SLX), and Defiance Next Gen Connectivity ETF (FIVG). They hold some of the largest and most profitable companies in their industries. Once you pull up the ETF you like best, you could consider selling a put option at a strike price around 5% below the current share price. Again, this would give you upfront cash… and position you for a chance to buy discounted shares in an ETF that should grow as this Anomaly Window plays out. (The above scenario is just one example of how to play the current trend and is not an official recommendation.) | Recommended Link | | Hey! Look at this RARE 5,100% chart: That’s from a REAL trade recommendation. It was only sent to a small circle of readers. You could’ve gotten in for 19¢. And now it’s at as much as $9.88. That’s a rare 5,100%. $1,000 grows into $52,000. But it’s NOT an options play. Just what IS this weird way to trade? -

And why it can cost as little as 19¢ to get in… -

With extraordinary gains as high as 5,100%… -

PLUS: Warren Buffett’s connection to all of this… | | | -- | Get Your Instant Cash Payouts Now Now, selling put options does come with some risk. There’s a chance the companies could drop significantly in price – and you’re “put” the stock and show a loss on paper. So always make sure you do your homework before initiating any trade… and only sell puts on stocks you’d be happy to hold if the trade doesn’t work out. At PBRG, we only make low-ball offers on the best companies in the market – the type of companies we want in our portfolio. They dominate vital industries. They gush free cash flow and profits. And they look after their shareholders. So, if you want to harness elite hedge-fund-type strategies like our Instant Cash Payout method, we’ve put together an entire service for you. It’s called Alpha Edge. And Daily editor Teeka Tiwari held a presentation last week to show you how we’ll use its strategies to generate crypto-like gains from boring blue-chip stocks during this Anomaly Window. It’s only a matter of time before trillions in new infrastructure spending rushes into the stock market. And with COVID still affecting the country… we’ll likely see even more spending proposals that prolong the current Anomaly Window. Our Instant Cash Payout method lets you take advantage of the blue-chip companies that will benefit from this spending… and potentially make crypto-like gains from these usually boring companies. Invest wisely, William Mikula

Analyst, Palm Beach Daily P.S. By watching Teeka’s free presentation today, you’ll not only learn more about his Anomaly Window strategy, but you’ll also receive his list of 30 elite stocks to trade during the current window – no strings attached… Click here to watch.

Like what you’re reading? Send us your thoughts by clicking here. IN CASE YOU MISSED IT… New Investment "Craze" Hits All 50 States In the past two years, over 100,000 people from all across the world have joined a new investment "movement." The strategy they've discovered has nothing to do with diversification… Buy and hold… Or anything you might hear from a broker or financial planner. But if history is any guide, you could have the chance to see double- and triple-digit gains over and over again – sometimes in a matter of days and weeks. Details here.

Get Instant Access Click to read these free reports and automatically sign up for daily research. |

没有评论:

发表评论