Both Trump and Harris appear more crypto friendly … SEC Chair Gensler might be on the way out … Luke Lango calls for a Big Tech resurgence … the AI 2.0 Trade Gary Gensler is the most hated man in the crypto industry. Gensler, the Securities and Exchange Commission chair, has sued Coinbase, the largest U.S. crypto exchange, as well as Binance, and Kraken… he’s gone after various crypto tokens such as Ripple (XRP), trying to treat them as unregistered securities… and his overall attitude toward crypto has been so adversarial that it’s prompted rebukes from politicians. One of the most recent examples came from Congressman Tom Emmer speaking at the Consensus Conference – an annual conference for the cryptocurrency and blockchain community – in the spring, saying: Gary Gensler has been the worst thing that could ever have happened to the SEC. He has gone way beyond the authority that he has. He literally violates the mission of the SEC everyday…

His open-door policy is the biggest frock that, you know what that ever existed. It’s literally, come on in, tell me what your project is, and then we’re going to sue you. Well, over the weekend, when Republican presidential nominee Donald Trump gave the keynote speech at the Bitcoin Conference in Nashville, he said that if he wins the White House in November, he’ll fire Gensler on Day One. The comment prompted thunderous applause from those in attendance. Here’s more from Trump: This afternoon, I’m laying out my plan to ensure that the United States will be the crypto capital of the planet and the Bitcoin superpower of the world, and we’ll get it done.

We will have regulations, but from now on, the rules will be written by people who love your industry, not hate your industry. Trump made a handful of promises in his keynote speech, all very bullish for crypto Beyond his promise to fire Gensler, Trump said he would: - Create a “strategic national bitcoin stockpile”

- Create a presidential advisory council to design transparent crypto regulation

- Stop working on a central bank digital currency, which many in the crypto community see as a threat to the whole purpose of digital currencies (getting beyond government issued currency and centralized control)

- Promote stablecoins, as Trump said they would help extend the dollar’s dominance around the globe

- Commute the sentence of Silk Road founder Ross Ulbricht (Silk Road was the first major platform for crypto traders).

Between the speech and early Monday, bitcoin jumped, nearly retaking $70,000 while hitting its highest level since mid-June. Since then, it’s pulled back due to fear that the U.S. government may flood the market with $2 billion of seized bitcoin from the defunct platform Silk Road. | ADVERTISEMENT  Louis Navellier, Eric Fry, and Luke Lango just sat down for an emergency AI roundtable discussion. They revealed a new AI development with millions of retirements in its cross hair and nobody is safe.

Watch their discussion to prepare yourself. | Even if Vice President Harris takes the White House, recent reports suggest she’s more friendly to the crypto sector than President Biden has been Let’s go to Fortune Crypto: Advisers to Vice President Kamala Harris’s campaign have been contacting key players in the crypto industry to develop relationships that could eventually inform a regulatory framework, sources told the Financial Times.

In recent days, that outreach effort has included crypto exchange Coinbase, stablecoin company Circle, and blockchain payments firm Ripple Labs, according to the report.

One source told the FT that the message Harris wants to send is that Democrats are “pro-business, responsible business.”

Her elevation to the top of the Democratic presidential ticket is also seen as a chance to reset relations with the tech sector after the Biden administration’s regulatory stance created a backlash in what has traditionally been a more liberal-leaning industry. On Friday, the CEO of Ripple, Brad Garlinghouse posted a speech of Rep. Brad Sherman attacking the crypto community. Garlinghouse added the commentary, “It would behoove VP Harris to not listen to (and distance herself asap from) folks like this who spout utter nonsense.” He then went on to write: The Dems aren't winning any votes for being anti-crypto (and thus anti-innovation), while the Republicans are gaining votes for embracing and encouraging innovation here in the US.

It’s time to catch up with so many other leading economies and governments with clear rules of the road. Even if Harris isn’t a crypto proponent to the degree that Garlinghouse wants, it’s a step in the right direction. Bottom line: A warmer relationship with the crypto community appears to be one area of overlap between Trump and Harris. So, though we expect plenty of volatility, we recommend you hold onto your crypto

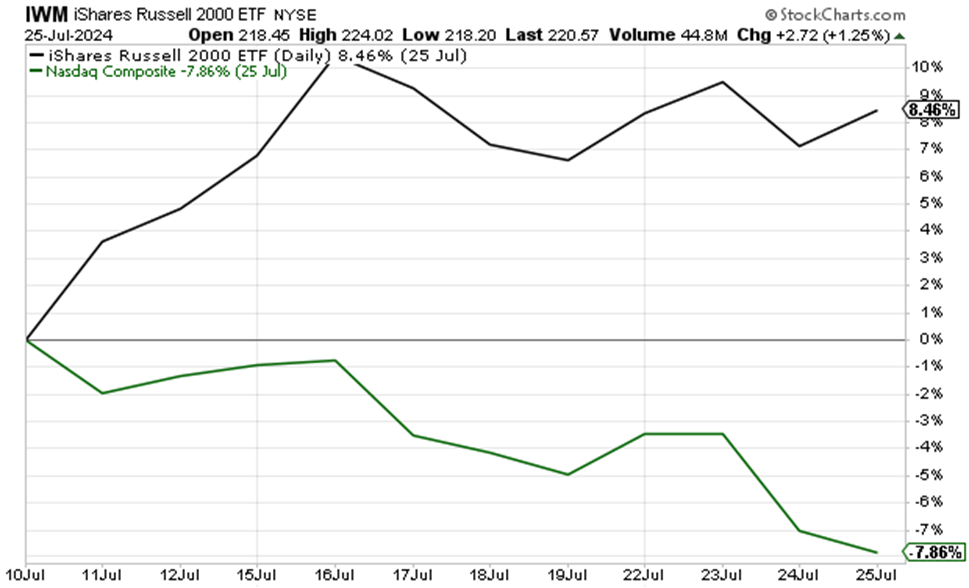

Meanwhile, Gary Gensler might want to update his resume. Switching gears to look at the broader tech sector, are we on the cusp of a new tech melt-up? As we’ve covered here in the Digest, the last two weeks have bought a historic rotation out of tech stocks, into small-cap stocks. Between July 11 and 25, the Nasdaq slumped 8% while the small-cap iShares Russell 2000 ETF jumped more than 8%.  But if our tech expert Luke Lango is right, we’re about to see a major tech resurgence. As he writes below, there are four fundamentals underpinning his bullishness: - Earnings are strong because companies are spending billions to build and integrate new AI products and services. We believe that trend should continue because AI adoption at both the enterprise and consumer levels remains low and will only increase over the next few quarters and years.

- Inflation is falling toward the Fed’s 2% target and, indeed, is almost there already. That should continue as well. Business surveys suggest that broadly speaking, companies have stopped hiking prices. Meanwhile, commodity prices – like oil and copper – have been in a freefall over the past several weeks.

- The outlook for Fed rate cuts is improving, and we think that will remain the case. With inflation back to nearly 2% and the job market starting to crack, it seems likely that the Fed will cut rates multiple times over the next six months.

- The economy is growing at a healthy pace. And with both inflation and interest rates set to fall in the coming months, the U.S. economy should only strengthen going forward.

Zeroing in on Luke’s bullet point about earnings and AI, this is a huge week Four of the biggest mega-cap tech players that are driving the AI bull market report earnings. There’s Microsoft that reports today after the closing bell (the results should be out by the time you read this). Tomorrow brings Meta. And on Thursday, we get Apple and Amazon. Investors are looking for evidence that the AI boom isn’t just hype. Luke expects we’ll get such proof with strong earnings coming in. In fact, he’s buying top AI stocks today: We like high-quality AI stocks on this dip. They were at the epicenter of all the recent selling, so they’ll likely be at the epicenter of the coming bounce, too.

Think names like Nvidia (NVDA), Super Micro (SMCI) and Arm (ARM). All are down about 10% over the past month.

Yet, AI firms are broadly reporting very good earnings. And those strong fundamentals will create robust demand for those stocks on this rebound. | ADVERTISEMENT  Is it any surprise 31 billionaires (including: Warren Buffett, Elon Musk, Jeff Bezos, and more) are quietly unloading their OWN stocks at record pace?

They’re getting OUT of AI (and Tech Stocks) before it’s too late.

But why?

And WHERE are they moving their cash for the biggest profits, in 2024?

Click here to discover all the details. | That said, Luke believes we’re at an inflection point in the AI boom Specifically, we’re entering a new phase where AI software stocks will take over leadership in the AI revolution. Louis Navellier and Eric Fry share this opinion. To help investors navigate this shift, last Friday, these three experts released their latest AI research on the opportunity. It’s part of a special briefing you can access right here. Back to Luke on this change: The AI revolution is entering a new phase, shifting focus from hardware to software.

Companies like Nvidia have already seen significant gains in this second phase... but the real opportunity lies in identifying the next Amazon, Netflix, or Microsoft of the AI era. Again, to read the full briefing, click here. Finally, an AI resurgence could see a huge shot in the arm tomorrow if the Fed sounds as dovish as is hoped Tomorrow, the Federal Reserve concludes its July meeting. Wall Street is looking for Chair Jerome Powell to sound dovish in his press conference, all-but-confirming rate cuts in September (and hopefully, telegraphing more cuts later in the year). If Wall Street gets this dovish version of Powell, we'll be looking for that mega-cap AI stock resurgence as Luke suggests. We’ll keep you updated.

Have a good evening, Jeff Remsburg |

没有评论:

发表评论